- Bull Street

- Posts

- 📈 Buffett's $382B Cash Fortress

📈 Buffett's $382B Cash Fortress

When the world's most successful bargain hunter sits on $382 billion in cash and refuses to buy even his own stock, the rest of us should at least pause to ask why.

Good Morning…

When the world's most successful bargain hunter sits on $382 billion in cash and refuses to buy even his own stock, the rest of us should at least pause to ask why—though the answer might surprise you.

Warren Buffett's final quarterly report as Berkshire Hathaway's CEO reveals not just market caution, but a masterclass in patience that could create the very opportunity contrarian investors have been waiting for.

🔎 Market Trends → Wall Street stocks end higher on Amazon boost

🖥️ Market Movers from Fintech.tv → [WATCH] Unlocking Value: How Sharps Technology Leverages Solana for Growth

And now…

⏱️ Your daily briefing for Monday, November 3, 2025:

MARKET BRIEF

Before the Open

As of market close 10/31/2025

Pre-Market

|

|

Fear & Greed

Markets in Review

AI Tailwinds Keep Markets Poised for More Gains

U.S. stock futures opened mostly flat to kick off November.

The S&P 500 and Dow closed +2.3% and +2.5% in October, while the Nasdaq led with a +4.7% surge.

The Big Picture:

The market enters November with a quiet start — but beneath the still surface, bullish currents are pushing hard.

Momentum remains anchored in AI-driven spending, easing U.S.–China trade tensions, and a remarkably resilient earnings season. More than 80% of S&P 500 companies reporting Q3 results have beaten expectations — a familiar refrain in a cycle where innovation is paying actual dividends.

Policy tailwinds matter too: The Fed is turning dovish, rate cuts are expected, and quantitative tightening is set to end Dec. 1 — potentially releasing liquidity back into the system. Historically, November is the strongest month for the S&P 500, averaging +1.8%.

Yes, Washington risk looms — the ongoing government shutdown continues to delay key economic data, and the Supreme Court is preparing to weigh in on Trump-era tariffs. But investors aren’t flinching.

Commodities stayed calm. Oil edged steady, while macro anxiety failed to rattle equity markets — suggesting investors are confident the growth story remains intact.

Market Movers:

Gainers: AI beneficiaries — Palantir (PLTR), AMD (AMD) — riding the wave of corporate data-infrastructure spending as Q3 earnings cement demand.

Financials push forward — banks are quietly embracing blockchain adoption, supporting cost-efficiency narratives.

Laggards: Tariff-sensitive industrials remain cautious as policy uncertainty lingers.

What They’re Saying:

“Fundamentally, the U.S. earnings picture remains strong… AI spending visibility remains strong… the Fed is dovish… and QT is ending Dec. 1.”

— Tom Lee, Fundstrat

WHAT WE’RE WATCHING

Events

These events are scheduled but may be effected by the government shutdown

Today: Institute for Supply Management - ISM Manufacturing PMI - 10:00am

Why You Should Care: It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy;

Earnings Reports

Today: Palantir, Vertex, Williams, Simon Property, Realty Income, IDEXX, Ares Management, Diamondback Energy, PSEG, Franco-Nevada

Tomorrow: Advanced Micro, Shopify, Uber, Arista Networks, Amgen, Eaton, Pfizer, Spotify, Ferrari, BP, Itau Unibanco, Marriott, Apollo Global

MARKET INSIGHTS

Leading News

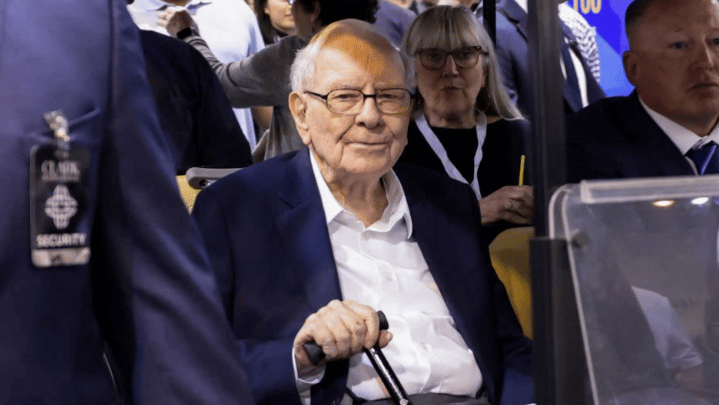

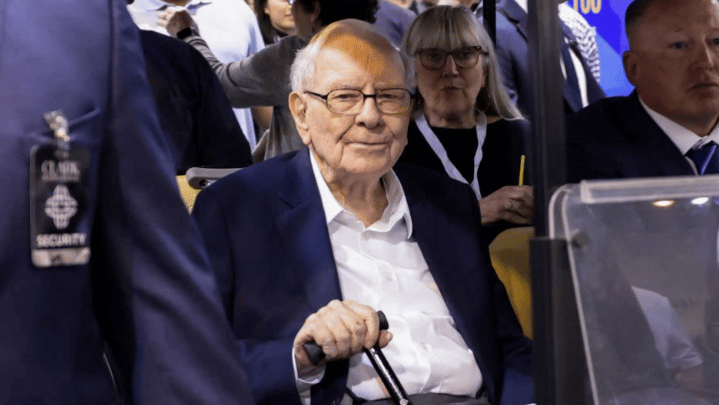

Buffett's $382B Cash Fortress: Caution Signal or Golden Opportunity?

Photo Credit: Scott Morgan/Reuters

Why it matters:

Warren Buffett is sitting on a record $382 billion cash pile at Berkshire Hathaway (BRK.A, BRK.B)—his final quarterly report as CEO shows he's finding fewer bargains worth buying in today's market.

Zoom Out:

The Oracle of Omaha sold stocks for the 12th consecutive quarter while letting cash compound at 5%+ in T-bills. Operating profit jumped 34% to $13.5 billion, proving Berkshire's business engine still roars even as Buffett prepares to hand the keys to Greg Abel at year-end.

Here's the behavioral finance tell: When the world's greatest value investor can't find value, retail investors should pay attention—but not panic. Berkshire's stock has lagged the S&P 500 by 32 percentage points since the succession announcement, creating potential entry points.

The cash hoard isn't paralysis—it's patient capital waiting for the inevitable market dislocation. History shows Buffett's biggest wins came when he deployed reserves during panics others couldn't stomach.

Key Insights:

Zero buybacks for 5 quarters signals Buffett thinks even his own stock is expensive—a humbling admission that speaks volumes about current valuations

$9.7B Occidental Petroleum chemicals deal shows successor Abel is already deploying capital differently than Buffett would

Insurance underwriting remains golden—lower loss projections boosted results despite Geico spending more on customer acquisition

Market Pulse:

"Berkshire letting cash build to these levels isn't a market timing call—it's Buffett admitting he can't find businesses trading below intrinsic value. That's sobering, but also means dry powder exists when sentiment shifts," notes a longtime Berkshire shareholder.

Bull’s Take:

That $382 billion isn't dead money—it's loaded ammunition for the next crisis, likely earning solid risk-free returns while positioning Berkshire to buy when others can't. Patient investors buying the dip get both value now and optionality later.

Market Stories of Note

BofA Lifts Alphabet Target to $335: Cloud Backlog Signals AI Profit Engine Firing Up:

Bank of America raised its Alphabet price target 20% to $335 after Q3 earnings revealed Google Cloud's $155 billion backlog—up $49 billion in one quarter—proving AI demand is converting into locked-in enterprise contracts rather than remaining speculative froth. The company's proprietary TPU chips are capturing margin-rich market share against Nvidia while pushing Cloud operating margins to 23.7%, and Gemini's 650 million users demonstrate search cannibalization fears were overblown. For patient investors, this is textbook, buy quality when fundamentals finally force Wall Street's hand.

GLP-1 Market Evolution: Pills, Price Wars, and the $150B Prize:

The weight-loss drug wars are shifting from supply shortages to market-share battles as Eli Lilly captures 57% of the GLP-1 market while Novo Nordisk's stock has tumbled 40%—a textbook lesson in how fast competitive moats erode. Oral pills arriving later this year could expand access to 170 million patients, but insurance coverage remains uncertain as employer drug claims from GLP-1s have surged to 10.5% of total costs. Investors face a classic dilemma: Lilly and Novo dominate today's market, yet compounding pharmacies and Medicare price negotiations starting in 2027 could reshape profits faster than Wall Street expects.

SPONSORED

Company Spotlight

An investment that could save lives and help change the future

ARMR Sciences has reserved the Nasdaq ticker “$ARMR” and is nearing the close of its Series A 7% Convertible Preferred round for accredited investors.

America’s fentanyl crisis kills 200+ people a day and costs an estimated $2.7T annually. DHS has even classified fentanyl as a potential weapon of mass destruction.

Backed by Department of Defense funding and 6+ years of university-led preclinical research, ARMR’s lead candidate blocked 92% of fentanyl from reaching the brain and eliminated addictive behavioral effects in preclinical models.

Their leadership helped develop countermeasures for Ebola, Anthrax, and Dengue. Now they’re aiming to build a first line of defense against synthetic opioids—starting with fentanyl.

Investors in this round receive a 7% annual dividend until listing, automatic conversion to common at IPO, and a 25% discount to the IPO price. Targeted public listing: 2026.

The round is nearing its close. Accredited investors can review and invest now via InvestARMR.com.

This is a paid advertisement for ARMR Sciences. This communication relates to a private placement pursuant to Section 4(a)(2) and/or Rule 506(c) of Regulation D (accredited investors only) and to “testing‑the‑waters” materials for a potential Regulation A offering. No money or other consideration is being solicited for a Regulation A offering and, if sent, will not be accepted. Any offer is made only by the Private Placement Memorandum (and, if pursued, an offering statement on Form 1‑A); read these carefully at InvestARMR.com. The SEC has not approved or disapproved the securities. Investments are speculative, illiquid, and involve a high degree of risk, including possible loss of the entire investment. Reserving a ticker symbol is not a guarantee of going public; any listing is subject to approvals.

CRYPTO

Fear & Greed