- Bull Street

- Posts

- 📈 Bull market

📈 Bull market

S&P hits new all-time high, India overtakes Hong Kong as world’s fourth-largest stock market, voice cloning startup ElevenLabs achieves unicorn status, Wall Street opposition to Trump collapses, and Mr Beast nears $100 million TV deal with Amazon...

☕️ Good morning.

The Fast Five → S&P hits new all-time high, India overtakes Hong Kong as world’s fourth-largest stock market, voice cloning startup ElevenLabs achieves unicorn status, Wall Street opposition to Trump collapses, and Mr Beast nears $100 million TV deal with Amazon…

Your 5-minute briefing for Tuesday, January 23:

BEFORE THE OPEN

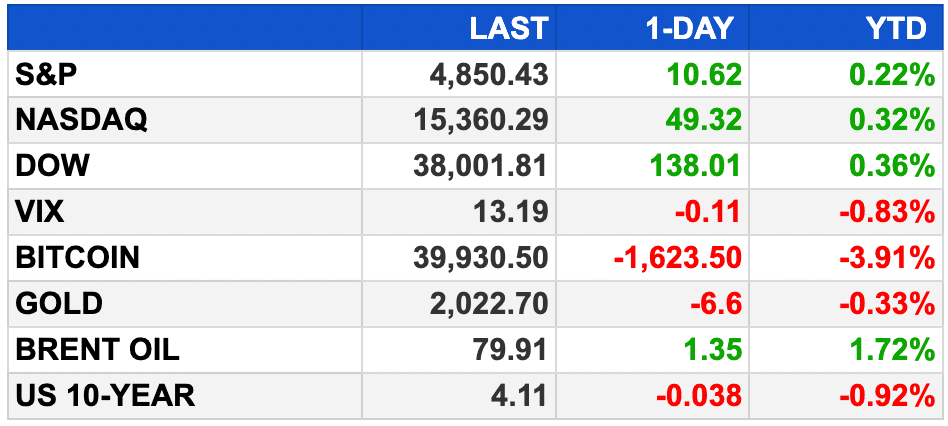

As of market close 1/22/2024.

PRE-MARKET

MARKETS

US stocks rose as the Dow and S&P hit all-time highs

The Dow led indices with a 0.36% gain to close above 38,000 for the first time

Asian stocks mostly rose, with Japan’s Nikkei notching a fresh 34-year high

Chinese stocks plunged as Hong Kong’s HSI approaches its lowest close since 2009

Bitcoin prices fell below $40,000, continuing a downtrend that began when bitcoin ETFs were approved

EARNINGS

United Airlines beat Q4 earnings and revenue expectations but forecasted a Q1 loss due to the FAA’s grounding of Boeing 737 Max 9 planes this month (link)

What we're watching this week:

Today: Netflix, Verizon, 3M, Johnson & Johnson, RTX, P&G, Lockheed Martin

Wednesday: Tesla, AT&T, IBM, ASML, Progressive

Thursday: Intel, Visa, Blackstone, American Airlines, Comcast, Next Era Energy

Friday: American Express

Full calendar here

NEWS BRIEFING

The S&P 500 surpassed Friday's record level and hit an intraday high of 4,868.41 points, confirming a bull market after closing at an all-time high in the previous session since its October 2022 closing low.

South Asian nation remains an investor darling in the new year. China’s economic struggles have stymied growth in Hong Kong.

Wall Street opposition to Trump collapses, as ‘pipe dream’ of primary defeat ends (link)

Dow touches 38,000 for first time (link)

Voice cloning startup ElevenLabs lands $80M, achieves unicorn status (link)

China weighs stock market rescue package backed by $278B (link)

US debt hits record high as rich economies pile on IOUs (link)

EU to upgrade economic security to shield key tech from China (link)

Home sales were the lowest in almost 30 years in 2023 (link)

Alphabet’s Moonshot X lab cuts staff, turns to outside investors (link)

Facebook made a major change after years of PR disasters, and news sites are paying the price (link)

Humans still cheaper than AI in vast majority of jobs, MIT finds (link)

Charles Schwab faces more uncertainty after tough 2023 (link)

Canada to cap international student permits amid housing crunch (link)

New details emerge about SEC’s X account hack, including SIM swap (link)

More workers want to change jobs, but the market is getting tougher (link)

Exxon sues two ESG investors (link)

Top House democrat seeks DOJ probe of AI-generated Biden robocalls (link)

Samsung races Apple to develop blood sugar monitor that doesn’t break skin (link)

Macy’s urged by Arkhouse to open books after rejecting takeover bid (link)

Fed review clears central bank officials of violating rules (link)

Southwest Airlines pilots approve new five-year contract (link)

CRYPTO

BULLISH BITES

🐝 Social buzz: Mr Beast nearing $100 million TV deal With Amazon.

🚘 Must-see: Ford’s impressive new 48-inch digital dashboard is a lot of Android for one car.

😤 Powershift: The end of workplace loyalty—can it be repaired?

🤖 AI-nxiety: This MIT study says AI won't take my job. But it doesn't make me feel too sure that AI won't take my job.

FEATURED TRADES

JPMorgan: Still a Buy with Record Earnings & Share Price Post Q4

JPMorgan Chase & Co. (ticker: JPM) is an American multinational investment bank and financial services holding company that provides a broad range of financial services, including investment banking, asset management, treasury and securities services, commercial banking, and retail banking.

Ticker: JPM | Price: $170.11 | Price Target: $225 (+32%)

Market Cap: $486B | Timeframe: by 2026 year-end

🏦 Banking | 💰 2.5% Dividend | 📈 Bullish Idea

Read the full article here. Read time: 7 min

DAILY SHARES

The Feast Of Bacchus, by Phillips de Koninck, 1654, 📸 by @k__h__r

— ArtButMakeItSports (@ArtButSports)

1:13 AM • Jan 22, 2024

What did you think about today's briefing? |

Keep the curation going! Buy the team a coffee ☕️