- Bull Street

- Posts

- 📈 Cleveland-Cliffs' Rare Earth Bet

📈 Cleveland-Cliffs' Rare Earth Bet

When a century-old steel maker pivots to rare earths and rockets 20%, you're watching either a value discovery or a fever dream.

Good Morning…

When a century-old steel maker suddenly pivots to rare earth minerals and the stock rockets 20% in a single session, you're watching either Wall Street's next great value discovery—or a commodity fever dream in real time.

Cleveland-Cliffs is betting it can turn Michigan tailings into strategic assets while China controls 93% of global rare earth processing, a wager that reveals as much about America's supply chain anxieties as it does about hidden optionality in industrial balance sheets.

🔎 Market Trends → Wall St ends sharply higher as earnings optimism fuels risk appetite

🖥️ Market Movers from Fintech.tv → [WATCH] Navigating the Rare Earths Battle: U.S. vs. China

And now…

⏱️ Your daily briefing for Tuesday, October 21, 2025:

MARKET BRIEF

Before the Open

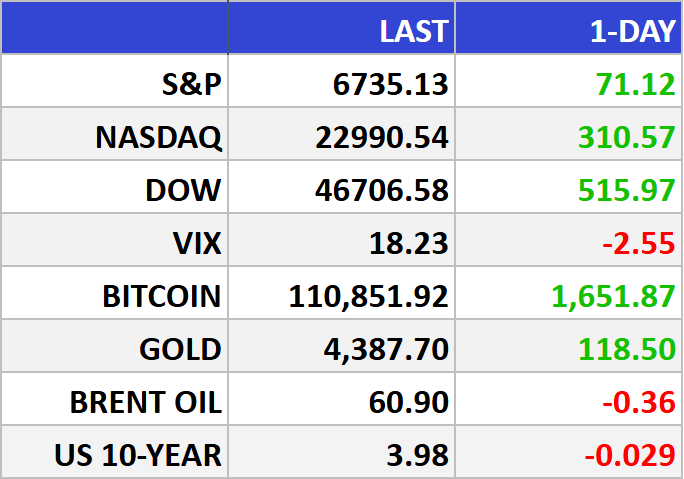

As of market close 10/20/2025

Pre-Market

|

|

Fear & Greed

Markets in Review

Stocks Break Out — A Bullish Pulse Amid Earning Strength and Risk-Fade

The Dow Jones Industrial Average closed up +1.12% at 46,706.58, the S&P 500 rose +1.07% to 6,735.13, and the Nasdaq Composite added +1.37% to 22,990.54.

The Big Picture:

The market rally reflects a shift in risk perception: traders are discounting the headline risks — namely the U.S. government shutdown and China-trade tensions — and refocusing on fundamentals, namely strong earnings and the prospect of a Federal Reserve rate cut. The upgrade of Apple Inc. (AAPL) on improving iPhone demand underlines the tech-led optimism.

Credit concerns—highlighted by recent regional bank woes—still exist, but buyers are willing to look past them for now. Meanwhile, oil and commodity inflation pressures are easing, which supports resilient margins for many sectors and opens room for equities to run.

In short: a market that seemed stuck is regaining breadth and momentum, as earnings and valuations align. The prudent investor should be bullish, while keeping one eye on policy and macro data.

Market Movers:

Apple (AAPL): Up nearly 4% on the day after a Loop Capital upgrade citing stronger iPhone 17 cycle. The stock is now at record highs — a sign of confidence in large-cap tech leadership.

Regional banks & credit: Zions Bancorporation and Western Alliance Bancorporation both jumped ~4% as loan-loss fears faded. That shift suggests the credit overhang may be less severe than feared.

Consumer staples lag: The sector slipped ~0.2% and was the only one in the red despite the rally. Names like Walmart Inc. and Hershey Co. eased ~1%. Defensive trades are underperforming, which signals risk-on sentiment.

What They’re Saying:

“Markets are exiting the funk of the ongoing tariff drama … and are now more focused on monetary policy and earnings, both of which are far more positive and consequential.” — Jamie Cox, Managing Partner at Harris Financial Group

WHAT WE’RE WATCHING

Events

There are no events scheduled for today.

Earnings Reports

Today: Netflix, GE Aerospace, Coca-Cola, Philip Morris, RTX, Capital One, Lockheed Martin, 3M, General Motors, Nasdaq

Tomorrow: Tesla, SAP, IBM, Thermo Fisher, AT&T, Lam Research, GE Vernova, Amphenol, Boston Scientific, CME Group, O'Reilly Automotive

MARKET INSIGHTS

Leading News

Cleveland-Cliffs' Rare Earth Pivot Could Unlock Hidden Value

Photo Credit: John Pana, cleveland.com

Why it matters:

America's steel giant (CLF) is betting its mining expertise can crack the critical minerals shortage—and Wall Street's bidding the stock up 20% on the pivot.

Zoom Out:

The rare earth trade has become 2025's hottest commodity play, driven by Washington's push for critical mineral independence from Beijing. China controls 70% of mining and a staggering 93% of oxide production—a strategic chokehold that makes semiconductor chips and EV batteries vulnerable.

Cleveland-Cliffs CEO Lourenco Goncalves sees opportunity in the company's existing Michigan and Minnesota mining operations. The logic is elegant: leverage infrastructure already in the ground, add geological surveys showing rare-earth mineralization, and potentially unlock a strategic asset hiding in plain sight within existing tailings basins.

The timing couldn't be sharper. Treasury Secretary Bessent heads to Malaysia this week for trade talks, while Defense Department capital floods into domestic miners like MP Materials (MP)—up 420% this year—and Trilogy Metals (TMQ), which has surged 480%.

Key Insights:

The supply squeeze is real: William Blair analysts just initiated coverage on five rare earth plays with Outperform ratings, forecasting "material future growth supported by insatiable demand" and potential government equity stakes

CLF's edge over pure-plays: Unlike speculative miners, Cliffs operates a fully integrated supply chain with proven operational expertise—the rare earth pivot is optionality, not desperation

Valuation gap: While peers trade at nosebleed multiples, CLF still reflects its steel business fundamentals despite posting a $0.45 adjusted loss this quarter

Market Pulse:

"American manufacturing shouldn't rely on China or any foreign nation for essential minerals, and Cliffs intends to be part of the solution," CEO Goncalves declared.

Bull’s Take:

If Cliffs' geological surveys pan out, you're buying a vertically integrated rare earth producer at steel-industry prices—classic margin of safety with asymmetric upside in America's critical mineral buildout.

Market Stories of Note

Trump's $8.5B Australia Bet Reshapes Supply Chain:

The White House inked an $8.5 billion critical minerals framework with Australia that transforms geopolitical anxiety into an investable thesis—targeting China's chokehold on rare earth processing where Beijing controls the refining bottleneck for semiconductors, defense systems, and EV batteries. Australia brings actual processing infrastructure through partners like Alcoa rather than speculative mining claims, with the Pentagon funding a 100-ton gallium refinery that signals industrial policy with commercial follow-through. This deal crystallizes what was strategic hand-wringing into concrete project pipelines, letting disciplined investors separate genuine supply chain plays from flag-wavers—though Trump's promise of abundance "in a year" belongs in the political optimism file, not the engineering timeline drawer.

AWS Outage Proves Concentration Risk Real:

Amazon's cloud computing unit suffered a DNS failure that disrupted DynamoDB databases for several hours Monday, affecting millions across banking apps, gaming platforms, and social media—a pointed reminder that 30% market share means systemic vulnerability when infrastructure breaks. The outage generated 6.5 million Downdetector reports and rendered smart home devices temporarily useless, confirming Prof. Feng Li's warning about concentration risk in digital infrastructure. For investors, this isn't a sell signal on Amazon (AMZN) but rather a data point suggesting diversification across cloud providers matters for businesses—and by extension, for the tech holdings anchoring your portfolio.

CRYPTO

Fear & Greed

Headlines

Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We've teamed up with AltIndex to get our readers free access to their app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.