- Bull Street

- Posts

- 📈 CoreWeave Hits a Speed Bump

📈 CoreWeave Hits a Speed Bump

The market just served up a masterclass in why "beat and raise" isn't always enough

Good Morning…

The market just served up a masterclass in why "beat and raise" isn't always enough—and why the smartest investors are studying CoreWeave's stumble with wallets open, not shut.

The AI infrastructure company delivered a revenue beat that would make most CFOs pop champagne, yet watched its stock crater 6% because Wall Street suddenly remembered that building the backbone of artificial intelligence requires actual construction crews who occasionally run late.

🔎 Market Trends → Wall Street ends sharply higher; Nvidia, Palantir lead AI surge

🖥️ Market Movers from Fintech.tv → [WATCH] The Intersection of Credit and Technology: A Conversation with CredCore’s Saumil Annegiri

And now…

⏱️ Your daily briefing for Tuesday, November 11, 2025:

MARKET BRIEF

Before the Open

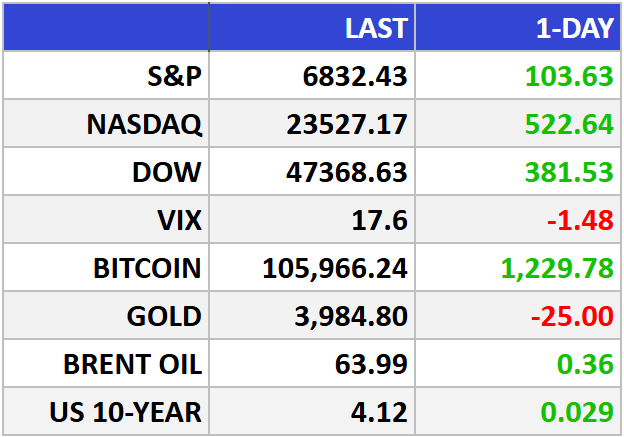

As of market close 11/10/2025

Pre-Market

|

|

Fear & Greed

Markets in Review

Shutdown Breakthrough Rekindles Risk Appetite

U.S. stocks ripped higher Monday as Washington inched toward ending the longest government shutdown in history.

The Dow gained +0.8%, the S&P 500 +1.5%, and the Nasdaq +2.3% — snapping last week’s slump as investors rushed back into AI leaders.

The Big Picture:

When Congress finally blinks, markets breathe.

A Senate procedural vote — crossing the critical 60-vote threshold — cleared the way for passage of a federal funding bill that would restart government operations through January and reverse recent layoffs. The measure could also restore confidence in workers and consumers, whose sentiment recently sank near record lows.

AI giants seized the moment. Nvidia (NVDA), Broadcom (AVGO) and Microsoft (MSFT) led tech higher, signaling that investors still prize innovation even amid valuation jitters. MSFT snapped its longest slide since 2011 — a reminder that even market monarchs occasionally wobble.

Energy and commodities traded mixed. With shutdown uncertainty easing, crude steadied on expectations of firmer year-end demand — but remained capped by cautious supply signals out of OPEC-plus talks. Gold held firm as investors hedge a still-fragile backdrop.

With shutdown worries fading, investors can again focus on fundamentals:

— AI earnings strength — still growing double digits

— Seasonality tailwinds

— A Fed leaning toward rate cuts by December

The wall of worry may be sturdy, but the market keeps climbing.

Market Movers:

AI megacaps Nvidia +~4%, AMD (AMD) +~4% as the shutdown thaw revived animal spirits. Their data-center revenue remains the crown jewel, growing ~20%+ YoY.

TreeHouse Foods (THS) +23% after a $3B buyout by Investindustrial — showcasing appetite for consumer staples.

Six Flags (SIX) –7% on a downgrade citing weak pricing power — a reminder that not all discretionary names are created equal.

What They’re Saying:

“We’ve taken one of three major concerns off the table… We’re still optimistic on risk assets into year-end.”

— Tim Holland, Orion CIO

WHAT WE’RE WATCHING

Events

There are no events scheduled for today

Earnings Reports

Today: Sea Limited, Alcon Inc., AngloGold Ashanti PLC

Tomorrow: Cisco, Nu Holdings, TransDigm, Manulife, Flutter Entertainment, Tencent Music Entertainment Group

MARKET INSIGHTS

Leading News

CoreWeave's AI Gold Rush Hits a Speed Bump—But the Mine's Still Producing

Photo Credit: Yuki Iwamura / Bloomberg via Getty Images

Why it matters:

The AI infrastructure darling beat Q3 revenue estimates by $70 million but stumbled on guidance, offering investors a reality check on the pace—not the promise—of the AI buildout.

Zoom Out:

CoreWeave (CRWV) posted $1.36 billion in Q3 revenue, up 134% year-over-year, handily topping the Street's $1.29 billion estimate. Yet the stock shed 6% after-hours as management guided full-year 2025 revenue to $5.05-$5.15 billion—shy of the $5.29 billion consensus.

The culprit? A third-party data center developer running behind schedule. CEO Mike Intrator was quick to note this affects just one facility in a 32-site portfolio, and critically, won't dent the company's $55 billion backlog—which nearly doubled from last quarter.

Meanwhile, the losses are narrowing fast: Q3's $110 million net loss marks serious improvement from $360 million a year ago. With mega-deals from OpenAI ($6.5B expansion) and Meta (up to $14.2B over six years), CoreWeave remains the infrastructure picks-and-shovels play for the AI era.

Key Insights:

Supply constraints = pricing power: Intrator emphasized they're not starved for power but for "powered-shell" data centers to house Nvidia GPUs. Translation: demand still exceeds capacity, supporting premium pricing.

CapEx tsunami ahead: CFO Nitin Agrawal projects 2026 capital expenditures will "well exceed double" this year's $12-$14 billion spend—a staggering commitment that signals management sees years of runway.

Backlog visibility: That $55 billion in contracted revenue (up from $30.1B in Q2) provides multi-year earnings visibility rarely seen in high-growth tech.

Market Pulse:

"Investors have gotten a lot more sensitive to the balance between growth and spend," said Dave Mazza, CEO at Roundhill Financial, capturing Wall Street's newfound sobriety about AI infrastructure investments after the stock's 22% plunge last week.

Bull’s Take:

Short-term hiccups in the construction schedule don't change the thesis: CoreWeave sits at the nexus of insatiable AI compute demand with blue-chip customers locked in for years. For patient investors, this dip is noise in a multi-year signal.

Market Stories of Note

Paramount's Layoff Math Gets More Aggressive—and Investors Are Applauding:

David Ellison's Paramount Skydance missed Q3 revenue estimates ($6.7 billion versus $6.97 billion expected) but juiced the stock 5% after-hours by upping merger cost savings from $2 billion to $3 billion—proof that Wall Street still prefers a credible restructuring story to top-line perfection. The bull case hinges on streaming's $340 million profit and 24% subscriber revenue growth, even as Ellison spends aggressively on UFC rights ($7.7 billion) while surgically trimming legacy TV's predictable decline with another 1,600 job cuts.

Waymo Hires a Finance Pro Who Knows How to Take Moonshots Public:

Alphabet's Waymo tapped Steve Fieler—a 30-year finance veteran who led Google's investor relations and served as HP's CFO—as its new finance chief, signaling the robotaxi pioneer is thinking seriously about outside capital or perhaps an eventual IPO. The hire comes as Waymo operates commercial services in five U.S. cities with two more launches planned for 2026, even while Alphabet's "Other Bets" segment bleeds $1.43 billion quarterly on $344 million in revenue. Fieler's rare blend of startup grit and public-company polish suggests management recognizes it must eventually articulate a profitability path that satisfies investors beyond its infinitely patient corporate parent.

SPONSORED

Company Spotlight

An investment that could save lives and help change the future

ARMR Sciences has reserved the Nasdaq ticker “$ARMR” and is nearing the close of its Series A 7% Convertible Preferred round for accredited investors.

America’s fentanyl crisis kills 200+ people a day and costs an estimated $2.7T annually. DHS has even classified fentanyl as a potential weapon of mass destruction.

Backed by Department of Defense funding and 6+ years of university-led preclinical research, ARMR’s lead candidate blocked 92% of fentanyl from reaching the brain and eliminated addictive behavioral effects in preclinical models.

Their leadership helped develop countermeasures for Ebola, Anthrax, and Dengue. Now they’re aiming to build a first line of defense against synthetic opioids—starting with fentanyl.

Investors in this round receive a 7% annual dividend until listing, automatic conversion to common at IPO, and a 25% discount to the IPO price. Targeted public listing: 2026.

The round is nearing its close. Accredited investors can review and invest now via InvestARMR.com.

This is a paid advertisement for ARMR Sciences. This communication relates to a private placement pursuant to Section 4(a)(2) and/or Rule 506(c) of Regulation D (accredited investors only) and to “testing‑the‑waters” materials for a potential Regulation A offering. No money or other consideration is being solicited for a Regulation A offering and, if sent, will not be accepted. Any offer is made only by the Private Placement Memorandum (and, if pursued, an offering statement on Form 1‑A); read these carefully at InvestARMR.com. The SEC has not approved or disapproved the securities. Investments are speculative, illiquid, and involve a high degree of risk, including possible loss of the entire investment. Reserving a ticker symbol is not a guarantee of going public; any listing is subject to approvals.

CRYPTO

Fear & Greed