- Bull Street

- Posts

- 📈 CoreWeave's $14B Meta Win

📈 CoreWeave's $14B Meta Win

This is a real-time stress test of whether AI's picks-and-shovels play generates profits or just press releases.

Good Morning…

CoreWeave just signed a $14.2 billion deal with Meta that sent its stock soaring 16%—yet one top analyst insists the company "destroys value with every data center they build," creating perhaps the most fascinating disagreement in AI infrastructure today.

🔎 Market Trends → Wall Street closes higher as investors shrug off US shutdown

🖥️ Market Movers from Fintech.tv → [WATCH] AI Takes Center Stage: How Helios Is Powering the Next Wave of Global Policymaking

And now…

⏱️ Your daily briefing for Thursday, October 2, 2025:

MARKET BRIEF

Before the Open

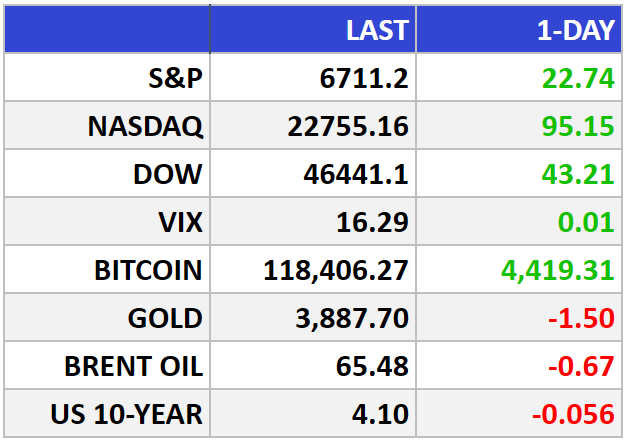

As of market close 10/01/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Shutdown? Markets Yawn. S&P tops 6,700 as buyers lean in

S&P 500 +0.34% to 6,711.20 (record). Nasdaq +0.42% to 22,755.16 (record). Dow +0.09% to 46,441.10.

The Big Picture:

Wall Street treated Washington’s drama like background noise. History says shutdowns dent confidence, not cash flows. Traders bet this one is short and shallow, and the tape agreed.

Leadership broadened beyond mega-cap AI: health care ripped, with Regeneron (REGN) and Moderna (MRNA) pacing gains, while drug majors (PFE, MRK, LLY, AMGN) extended Tuesday’s policy-fueled rally. That’s a classic late-cycle rotation toward defensive growth.

Macro signals were mixed. ADP showed private payrolls –32k, reinforcing a gentle-cooling labor market. Yields whipsawed and the 10-year hovered near ~4.1%, easing the equity discount rate. The dollar stayed soft; crude held in the low-$60s, a quiet tailwind for margins unless it’s forecasting weaker demand.

Market Movers:

Pharma & biotech: Regulatory clarity and tariff reprieves lifted sentiment; investors chased cash-rich balance sheets and pipeline optionality.

Fermi America (IPO) popped on day one—data center power is the picks-and-shovels trade for AI compute.

Corteva (CTVA) slid on breakup plans; near-term conglomerate discount before any sum-of-parts rerate.

Money-center banks: JPM, GS softened as a shutdown-driven data blackout muddies near-term credit and trading visibility.

What They’re Saying:

“The market appears unconcerned… Momentum remains positive.” — Louis Navellier, Navellier & Associates.

WHAT WE’RE WATCHING

Events

Scheduled Today (Govt. Shutdown May Effect): Department of Labor - Unemployment Claims - 8:30am

Why You Should Care: Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy.

Earnings Reports

Today: AngioDynamics

Tomorrow: There are no noteworthy companies for tomorrow.

MARKET INSIGHTS

Leading News

CoreWeave Bags $14.2B Meta Deal—But Wall Street's Still Divided on the Math

Photo Credit: Yuki Iwamura / Bloomberg / Getty Images

Why it matters:

CoreWeave (CRWV) just landed a $14.2 billion contract through 2031 with Meta (META), vaulting its stock up 16%—yet some sharp analysts argue the company "destroys value with every data center they build." Welcome to the great AI infrastructure paradox.

Zoom Out:

CoreWeave now has $36.6 billion in total contracted revenue between Meta and OpenAI—a staggering validation that hyperscalers need specialized GPU clouds. The company's providing Meta access to Nvidia's (NVDA) cutting-edge GB300 systems, positioning itself as the Switzerland of AI compute between chip makers and model builders.

Here's the textbook behavioral finance trap: revenue growth that dazzles while unit economics remain murky. CoreWeave's solving real customer concentration risk—Microsoft was 70% of revenue in June—but whether renting Nvidia chips at scale generates sustainable margins is the $19 billion question (that's their valuation).

The bull case rests on scarcity: GPU capacity remains constrained, and CoreWeave can deliver faster than hyperscalers building from scratch. The bear case? D.A. Davidson's Gil Luria sees 70% downside, citing massive losses and the uncomfortable reality that CoreWeave pays Nvidia top dollar, then re-rents at compressed margins.

Key Insights:

The revenue mirage: Yes, $36.6B in contracts sounds magnificent. But these are multi-year commitments paid over time, not cash in hand. CoreWeave raised $1.3 billion in convertible debt recently—suggesting the cash conversion cycle requires constant feeding. Watch the free cash flow, not the headline contract values.

Customer diversification matters: Meta's deal drops Microsoft's concentration from 70% to something more palatable. Evercore ISI's Amit Daryanani (five-star analyst) initiated with a Buy and $175 target, betting diversification plus demand equals eventual profitability. That's the optimistic path—assuming AI spending doesn't hit an air pocket.

The unit economics gamble: CoreWeave's entire thesis depends on utilization rates staying high and Nvidia not squeezing margins. If GPU oversupply emerges (remember those crypto mining rigs?), or if customers build in-house capacity, CoreWeave's caught paying fixed costs on depreciating hardware. The bears aren't crazy—they're asking the right questions about return on invested capital.

Market Pulse:

"This is just the beginning of the second phase of AI investment," notes Tejas Dessai of Global X ETFs. Translation: the infrastructure layer is still forming, and CoreWeave's racing to establish moats before hyperscalers close the gap.

Bull’s Take:

CoreWeave's Meta win proves demand for specialized AI infrastructure is real and growing—but investors should demand proof that revenue growth translates to positive unit economics, not just bigger losses at scale. The stock's a speculation on AI's capex cycle continuing, not a value play. Size your position accordingly.

Market Stories of Note

Pfizer Cuts Trump a Deal: Tariff Shield for Price Cuts:

Pfizer just became the first major drugmaker to bow to Trump's "most favored nation" pricing ultimatum, promising Medicaid patients access to drugs at international prices—discounts averaging 50% and reaching 85% on select medications—while securing a three-year reprieve from pharmaceutical tariffs and pledging $70 billion in U.S. manufacturing and R&D. Wall Street yawned at the "optics over substance" announcement, with analysts noting Medicaid represents under 5% of Pfizer's U.S. sales and expecting the company to simply raise prices abroad rather than genuinely cut them domestically, making this more political theater than margin erosion. For investors, the blueprint matters more than the specifics: Trump's transactional tariff strategy now has a template that other pharma giants can follow to dodge the 100% import duties he threatened, removing a major overhang on sector valuations that had been suppressed to historic lows.

Intel's Foundry Gets Its Validation Moment: AMD in Talks:

Intel just popped 6% on news that archrival AMD is in early discussions to become a foundry customer—the kind of vote of confidence that CEO Lip-Bu Tan desperately needs to prove Intel's manufacturing transformation isn't just PowerPoint strategy. The behavioral finance lesson here is textbook: when your fiercest competitor trusts you with their chip production, it sends a market signal far more powerful than any earnings guidance, especially since AMD currently relies on TSMC and would be taking real execution risk by diversifying to Intel. For investors riding Intel's 77% year-to-date surge, this rumor validates the turnaround thesis that the U.S. government, Nvidia, and Softbank have already bet billions on—though smart money waits for actual contracts, not just "early talks," before declaring mission accomplished.

CRYPTO

Fear & Greed