- Bull Street

- Posts

- 📈 Google's AI Gold Rush

📈 Google's AI Gold Rush

OpenAI Commits $30B to Oracle, Kohl's Joins Meme Stock Rally, Amazon Acquires AI Wearables Startup, Lockheed Takes $1.6B Defense Hit, AstraZeneca Plans $50B US Bet

Good morning.

⚡ The Fast Five → OpenAI Commits $30B to Oracle, Kohl's Joins Meme Stock Rally, Amazon Acquires AI Wearables Startup, Lockheed Takes $1.6B Defense Hit, AstraZeneca Plans $50B US Bet

🔎 Market Trends → Preserve capital, don't swing 'for the fences,' portfolio manager says; US Futures Waver, Eyes on Earnings

And now…

⏱️ Your 5-minute briefing for Wednesday, July 23, 2025:

MARKET BRIEF

Before the Open

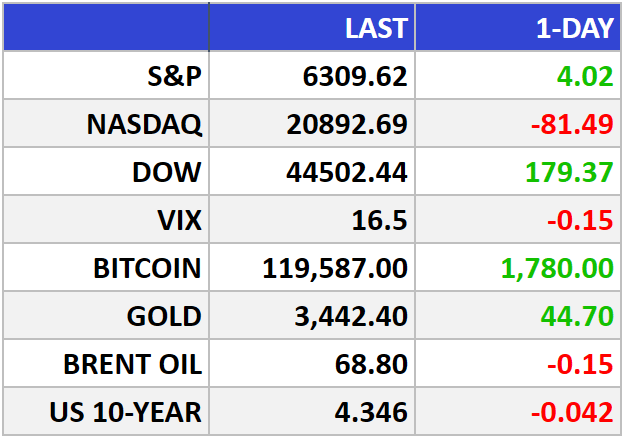

As of market close 07/22/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Builders Boom, Retail Pops as S&P Breaks Records Again

The S&P 500 notched another all-time high, up 0.1% to 6,309.6, while the Nasdaq broke a six-day winning streak, slipping 0.4%. The Dow led majors, rising 0.4%.

The Big Picture:

Despite turbulence in defense and autos, investors found strength in the fundamentals: housing and health care. With earnings season in full swing, markets showed they're willing to reward resilience—even in an environment laced with tariffs and geopolitical trade tweaks.

A surprising 38% spike in Kohl’s (KSS) and a 17% surge in D.R. Horton (DHI) signaled something bigger: consumer and homebuyer confidence remains intact, despite rate noise and macro jitters.

Meanwhile, energy cooled, with WTI crude down 1.3% to $66.36, as investors weighed future demand against new Asia-Pacific trade moves announced by Trump. Gold rallied 1.1% to $3,442.8, flagging rising hedging activity.

Market Movers:

D.R. Horton (DHI) +17%: Crushed earnings estimates. Investors are betting that housing demand will hold, even as rates bite.

Kohl’s (KSS) +38%: A classic short squeeze. No news, but aggressive buying halted the stock early in the session.

Lockheed Martin (LMT) -11%: Cut guidance, citing defense delays. Tariff blowback hit sentiment hard.

General Motors (GM) -8.1%: Took a $1.1B earnings hit from new tariffs. Still, long-term demand remains strong.

What They’re Saying:

“We’ll be working out what is likely an extension [of the China tariff truce] during talks in Stockholm.”— U.S. Treasury Secretary Scott Bessent

WHAT WE’RE WATCHING

Events

There are no events scheduled for today.

Earnings Reports

Today: Google (Alphabet Inc.), Tesla, AT&T, T-Mobile, IBM, Chipotle, Hilton

Tomorrow: Intel, Keurig Dr Pepper, Blackstone, Nasdaq, Honeywell, Vodafone, Deutsche Bank, Union Pacific, Valero

MARKET BRIEF

Leading News

Google's AI Gold Rush Meets Reality Check

Photo Credit: Pawel Cyrwinski

Why it matters:

Alphabet's Q2 earnings will test whether $75 billion in AI spending is translating to meaningful revenue growth — or if it's another tech bubble in disguise.

Zoom Out:

The Street expects 11.6% revenue growth to $79.6 billion, driven by AI-powered search queries that are twice as long as traditional ones. That's behavioral economics in action: when tools get smarter, humans ask more complex questions.

Google Cloud's projected 26% jump to $13.1 billion reveals the real prize here. While consumer AI grabs headlines, enterprise customers write the big checks — and they're apparently writing them fast.

The antitrust sword hanging over Google's head isn't just regulatory theater. A forced Chrome divestiture could crack the foundation of the world's most profitable advertising machine.

Key Insights:

AI capacity constraints remain Google's biggest operational headache. When demand outstrips supply this dramatically, it usually signals either massive opportunity or massive overspending — history suggests both can be true simultaneously.

Search monetization evolution will determine if longer AI queries mean higher revenue per search or just higher costs. The answer shapes whether this AI transformation creates or destroys shareholder value.

Cloud operating leverage shows the clearest path to profitability, with margins expected to hit 17% versus single digits just two years ago.

Market Pulse:

"We remain constructive on Google's ability to drive AI usage despite cautious sentiment," notes BofA's Justin Post — Wall Street speak for "we think this works, but we're hedging our bets."

Bull’s Take:

Google's 1.5 billion AI Overview users represent the largest monetizable AI audience on Earth. Smart money bets on the company that turns data into dollars better than anyone else.

Headlines

OpenAI to Invest $30 Billion Annually in Oracle Data Centers (link)

Kohl’s shares surge in value as retail investors breathe life into new meme stocks (link)

Amazon to buy AI company Bee that makes wearable listening device (link)

Lockheed records $1.6B in losses, mostly linked to continued strife on classified aero program (link)

Philip Morris says black-market cigarettes are a big deal, as sales miss and stock falls (link)

AstraZeneca Pledges $50 Billion U.S. Investment by 2030 (link)

CRYPTO

Fear & Greed

Headlines

*Hat-tip to timet1m3

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.