- Bull Street

- Posts

- 📈 Google's Historic $100B Quarter

📈 Google's Historic $100B Quarter

While most investors fretted over whether AI would ever turn a profit, Google just dropped a $102 billion quarter that answered the question emphatically.

Good Morning…

While most investors were obsessing over whether AI would ever make money, Google quietly proved it already is—to the tune of a $102 billion quarter that sent shares soaring 6% and left skeptics scrambling to revise their models.

The search giant's ability to convert artificial intelligence hype into contracted enterprise revenue (a $155 billion cloud backlog, to be precise) offers a masterclass in separating genuinely transformative technology from the speculative froth that typically surrounds it.

🔎 Market Trends → S&P 500 flat after Powell doesn't guarantee December Fed rate cut

🖥️ Market Movers from Fintech.tv → [WATCH] Convergence of Crypto and AI: Exploring New Use Cases at Money 20/20

And now…

⏱️ Your daily briefing for Thursday, October 30, 2025:

MARKET BRIEF

Before the Open

As of market close 10/29/2025

Pre-Market

|

|

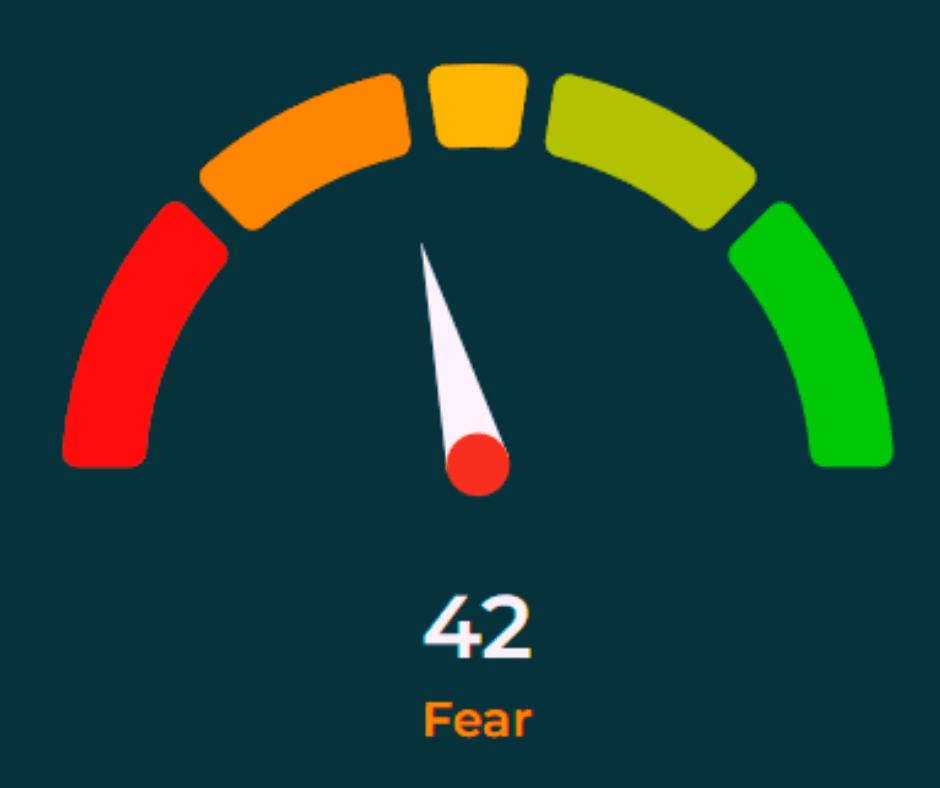

Fear & Greed

Markets in Review

Market Hiccups, Momentum Intact

The Dow slipped 0.2% to 47,632, surrendering early gains after Fed Chair Jerome Powell hinted December rate cuts aren’t guaranteed.

The S&P 500 (6,891) was flat, while the Nasdaq jumped 0.55% to a record 23,958, powered by Nvidia (NVDA).

The Big Picture:

Markets opened euphoric, with the Dow climbing more than +300 points to a fresh record, only to fade after Powell reminded investors that monetary policy isn’t on autopilot.

The Fed cut rates 25 bps to 3.75%–4%, the second trim this year — a quiet acknowledgment that growth is cooling but still resilient. Powell’s nuance: future cuts are possible, not promised. That’s central banking in plain English: they’re trying to land the plane without bending the wings.

Still, inflation is edging toward target, and financial conditions remain moderately loose — constructive soil for equities. Long yields popped back above 4%, a reflex to Powell’s caution.

Rate-sensitive names — Costco (COST), McDonald’s (MCD), Visa (V), Mastercard (MA) — wilted. But tech, the market’s new industrial base, shrugged and marched on.

Oil edged steady despite geopolitical noise, while commodities held rangebound, a sign the market still trusts the Fed’s glide path.

Market Movers:

Nvidia (NVDA) +3.1% → First U.S. firm to cross $5T market cap. A $1B stake in Nokia signaled the chipmaker isn’t just selling shovels in the AI gold rush — it’s buying the mines.

Caterpillar (CAT) +12% → Earnings crushed; biggest daily pop since 2009. Strong machinery demand says global building and mining aren’t done.

Stride (LRN) –50% & Avantor (AVTR) –17% → Both slumped on weaker guidance, reminders that execution still matters in a forgiving macro.

What They’re Saying:

“Markets were negatively surprised that future cuts might be taken off the table… but that decline should be a ‘buying opportunity.’”

— Chris Zaccarelli, Northlight Asset Management

WHAT WE’RE WATCHING

Events

There are no events scheduled for today.

Earnings Reports

Today: Apple, Amazon, Eli Lilly, Mastercard. Shell, Merck, S&P Global, Gilead, Stryker, TotalEnergies, BBVA, Anheuser-Busch, Comcast

Tomorrow: Exxon Mobil, AbbVie, Chevron, Linde, Aon, Colgate-Palmolive, Canadian National Railway, Dominion Energy, Imperial Oil

MARKET INSIGHTS

Leading News

Google's AI Engine Powers Historic $100B Quarter

Photo Credit: Firmbee.com

Why it matters:

Alphabet (GOOGL) just proved that artificial intelligence isn't just hype—it's a revenue machine capable of pushing a tech giant past the $100 billion quarterly threshold for the first time ever.

Zoom Out:

The search behemoth delivered $102.35 billion in Q3 revenue (up 16% YoY) and EPS of $2.87 (crushing the $2.33 consensus by 23%). Shares jumped 6% after-hours, validating what smart money has suspected: Google's "full-stack" AI approach is translating directly to the bottom line.

Here's what separates winners from pretenders: Google Cloud accelerated to $15.15 billion (up 35% YoY) with a jaw-dropping $155 billion backlog. That's not future potential—that's contracted revenue from enterprises betting their digital transformation on Google's infrastructure. The company signed more billion-dollar-plus deals in nine months than the previous two years combined.

The AI flywheel is spinning faster. Gemini now processes 7 billion tokens per minute through direct API usage, while YouTube ad revenue hit $10.26 billion (up 15%) as Shorts finally generates more revenue per watch-hour than traditional video in the U.S.

Key Insights:

CapEx surge signals conviction: Management raised 2025 guidance to $91-93 billion (from $85 billion), with CFO Anat Ashkenazi warning of "significant increases" in 2026. Translation? They're seeing ROI on data center buildout that justifies doubling down while competitors hesitate.

Search remains bulletproof: Core Search revenue of $56.57 billion (up 15%) proves AI Overviews and AI Mode are expanding the pie, not cannibalizing legacy business. Query growth actually accelerated in Q3—the opposite of what bears predicted.

Regulatory headwinds are real: The $3.5 billion EU antitrust fine hit operating margins, and a New York judge just ruled against Google in a separate ad-tech monopoly case. But excluding one-time charges, operating margin sits at 33.9%—enviable by any standard.

Market Pulse:

"We're seeing AI now driving real business results across the company," CEO Sundar Pichai told investors, noting the company has doubled its quarterly revenue since Q3 2020 while diversifying beyond search.

Bull’s Take:

Google's turning AI infrastructure spending into contracted enterprise revenue while maintaining search dominance—a rare combination of growth and durability. At 22x forward earnings, this isn't a speculation play; it's a cash-generating machine with a widening moat.

Market Stories of Note

Meta's $15.9 Billion Tax Hangover Obscures Another AI Spending Spree:

Meta beat earnings with adjusted EPS of $7.25 and revenue of $51.24 billion (up 26% YoY), but shares tumbled 9% on a one-time $15.9 billion tax charge from Trump's tax reform. The real story: Meta raised 2025 capex guidance to $70-72 billion and warned 2026 spending will be "notably larger" as Zuckerberg doubles down on "superintelligence"—yet the advertising engine keeps humming with $50 billion in ad revenue (up 26%) as AI-powered targeting drives 14% more impressions at 10% higher prices. For patient investors willing to look past accounting noise, Meta's core business remains a cash machine funding moonshots that may or may not pay off.

Microsoft's $3.1 Billion OpenAI Paper Loss Masks a $250 Billion Azure Windfall:

Microsoft's Q1 earnings absorbed a $3.1 billion accounting hit from its OpenAI stake—the sort of non-cash charge that separates investors who read footnotes from those who merely scan headlines. The restructured partnership locks in a $250 billion Azure services contract from OpenAI while crystallizing Microsoft's 27% equity position at a $135 billion valuation, effectively converting a speculative AI bet into contracted cloud revenue. What Wall Street initially viewed as defensive spending now looks like one of the shrewdest strategic investments in cloud computing history—if you're patient enough to ignore quarterly noise.

CRYPTO

Fear & Greed

Headlines

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.