- Bull Street

- Posts

- 📈 J&J's Stellar Beat

📈 J&J's Stellar Beat

TSMC Profit Surges 61% Record, Goldman Trading Revenue Boosts Profit, PepsiCo Beats Despite US Decline, Scale AI Cuts 14% Staff, Opendoor Technologies Stock Pops Today

Good morning.

⚡ The Fast Five → TSMC Profit Surges 61% Record, Goldman Trading Revenue Boosts Profit, PepsiCo Beats Despite US Decline, Scale AI Cuts 14% Staff, Opendoor Technologies Stock Pops Today

🔎 Market Trends → Wall St ends higher after brief slump on Powell firing confusion; U.S. Futures Drop Slightly

And now…

⏱️ Your 5-minute briefing for Thursday, July 17, 2025:

MARKET BRIEF

Before the Open

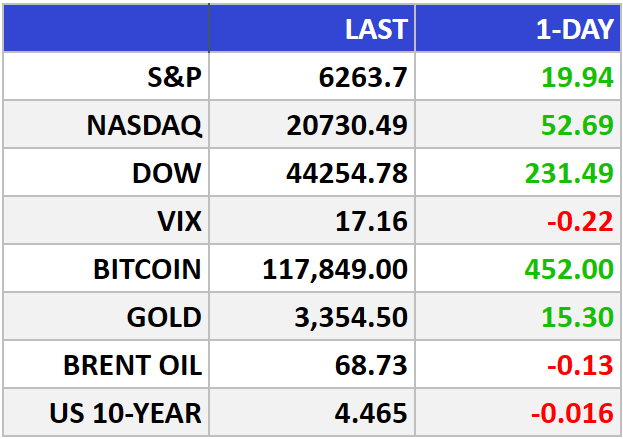

As of market close 07/16/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Markets Hold Gains as Trump Walks Back Powell Ouster Rumors

Dow +0.3% to 44,158.8, S&P 500 +0.2%, Nasdaq +0.1%, extending its record run. Health care led, while energy and discretionary lagged.

The Big Picture:

Markets breathed a little easier Wednesday after President Trump said it’s “highly unlikely” he’ll fire Fed Chair Jerome Powell, tamping down fears of Fed upheaval just as rate policy hangs in the balance. That helped stabilize equities after earlier pressure from stubborn inflation and swirling trade concerns.

Producer prices came in flat for June, thanks to weak travel demand offsetting a rise in tariff-tagged goods. This suggests pricing power may be peaking, and bond yields pulled back in response: the 2-year dropped to 3.88%, a notable dovish signal.

Crude oil (WTI) hovered at $66.49, while gold climbed 0.6% as investors sought a hedge amid macro noise.

Market Movers:

Johnson & Johnson (JNJ) +6.2%: Beat-and-raise quarter—strong pharma and MedTech momentum.

Omnicom (OMC) +4.6%: Solid earnings from the ad giant boosted investor sentiment on consumer trends.

Morgan Stanley (MS) -1.3%: Strong report overshadowed by profit-taking and cautious outlook.

Ford (F) -3.1%: Hit by a $570M recall expense tied to a fuel leak—sentiment worsens amid margin pressure.

What They’re Saying:

“Markets aren’t pricing in a Fed firing or a Trump-Powell war... but the mere suggestion shakes confidence,” — Oxford Economics

WHAT WE’RE WATCHING

Events

Today: Census Bureau - Core Retail Sales m/m; Retail Sales m/m - 8:30am

Why You Should Care: It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity;

Today: Department of Labor - Unemployment Claims - 8:30am

Why You Should Care: Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy;

Earnings Reports

Today: Netflix, PepsiCo, Abbott, GE Aerospace, Taiwan Semiconductor (TSMC), Novartis, U.S. Bank

Tomorrow : American Express, Charles Schwab, 3M , Truist (formerly BB&T and SunTrust), Schlumberger, Ally Financial

MARKET BRIEF

Leading News

J&J's Stellar Beat Signals Healthcare's Comeback Story

Photo Credit: Brendan McDermid/Reuters

Why it matters:

Johnson & Johnson's (JNJ) robust quarter and raised guidance suggest the healthcare giant is hitting its stride—and dragging the entire sector upward with it.

Zoom Out:

The numbers tell a compelling story: $23.74 billion in Q2 sales (beating estimates by nearly $1 billion), adjusted earnings of $2.77 per share (vs. $2.68 expected), and a stock that's surged 6.2% while climbing 14% year-to-date. This isn't just another earnings beat—it's validation that healthcare's defensive qualities are combining with genuine growth momentum.

What's particularly intriguing is J&J's $200 million reduction in expected tariff costs, freeing up capital for pipeline acceleration. The company's decision to reinvest this windfall rather than pocket it signals management's confidence in their R&D runway—a classic hallmark of sustainable competitive advantage.

The medtech division's 7.3% growth is especially noteworthy, driven by cardiovascular leader Abiomed and robust electrophysiology sales. This strength should lift peers like Stryker (SYK), Medtronic (MDT), and Boston Scientific (BSX).

Key Insights:

Cancer franchise firing: Darzalex revenue hit $3.5 billion (4% above estimates), while newer assets Carvykti and Erleada continue gaining traction in competitive oncology markets

Pipeline catalyst ahead: CEO Joaquin Duato highlighted upcoming approvals in lung cancer, bladder cancer, and depression—areas with massive addressable markets

Margin expansion opportunity: Lower tariff burden plus favorable FX effects create a $400 million tailwind for reinvestment

Market Pulse:

"The company is positioned for elevated growth in the second half," Duato noted, with submission timelines accelerating across multiple therapeutic areas.

Bull’s Take:

J&J's combination of defensive stability and growth acceleration makes it a rare breed in today's market—a Dow stalwart that's actually earning its premium valuation through innovation, not just dividends.

Headlines

TSMC profit surges 61% to record high fueled by AI chip demand (link)

Goldman Sachs Profit Surges on Higher Trading Revenue (link)

PepsiCo posts better-than-expected second quarter despite lower US sales (link)

Scale AI lays off 14% of staff, largely in data-labeling business (link)

Trump and the Energy Industry Are Eager to Power AI With Fossil Fuels (link)

Why Opendoor Technologies Stock Popped Today (link)

CRYPTO

Fear & Greed

Headlines

*Hat-tip to VCBrags

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.