- Bull Street

- Posts

- 📈 Microsoft's Cloud Empire Strikes Gold

📈 Microsoft's Cloud Empire Strikes Gold

Meta Surges Despite AI Costs, Figma IPO Prices Above Range, CVS Revenue Rises 8.4%, Robinhood Doubles, Crypto Disappoints, Samsung Profit Halves, Chips Plunge

Good morning.

⚡ The Fast Five → Meta Surges Despite AI Costs, Figma IPO Prices Above Range, CVS Revenue Rises 8.4%, Robinhood Doubles, Crypto Disappoints, Samsung Profit Halves, Chips Plunge

🔎 Market Trends → Equities retreat as Powell dampens Fed Sept cut hopes; Stock futures inch higher as investors analyze earnings, await Fed rate decision

And now…

⏱️ Your 5-minute briefing for Thursday, July 31, 2025:

MARKET BRIEF

Before the Open

As of market close 07/30/2025.

Pre-Market

|

|

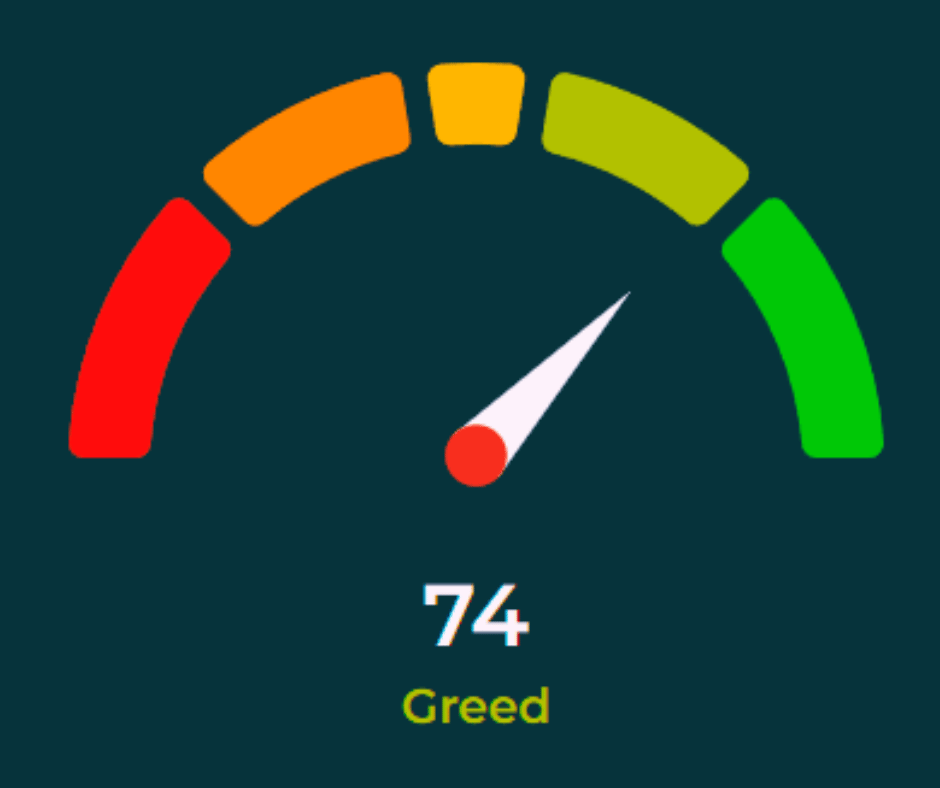

Fear & Greed

Markets in Review

Powell Holds the Line, Markets Trim Gains

The S&P 500 slipped 0.12% to 6,362.9, ending its record streak. The Dow fell 171 points (-0.38%) to 44,461.3, while the Nasdaq bucked the trend, inching up 0.15% to 21,129.7.

The Big Picture:

After six record closes, stocks cooled as Fed Chair Jerome Powell dashed hopes for an imminent rate cut. The central bank kept rates steady at 4.25%–4.5%, with Powell signaling a “wait and see” stance amid tariff-driven price pressures.

The Fed acknowledged that higher tariffs are filtering into consumer prices, but Powell stressed that long-term inflation expectations remain well anchored. Two dissenting governors pushed for a cut—hinting that the debate inside the Fed is far from over.

Earlier, a strong GDP report showed the economy is absorbing tariffs better than feared, briefly lifting markets before Powell’s remarks tempered the rally.

Market Movers:

Consumer stocks lagged: Retailers like Home Depot (HD) led declines as traders priced in a higher-for-longer rate environment.

Treasury yields spiked: The 10-year climbed as markets repriced expectations, reflecting Powell’s firm stance.

Nasdaq held firm: Tech resilience, supported by ongoing earnings strength, kept the index in positive territory.

What They’re Saying:

“Powell isn’t buckling under political pressure to cut rates… Markets needed to reprice where the Fed Funds rate will be, but the reaction wasn’t that bad.”— Jamie Cox, Harris Financial Group

WHAT WE’RE WATCHING

Events

Today: Bureau of Economic Analysis - Core Personal Consumption Expenditures (PCE) Price Index m/m - 8:30am

Why You Should Care: It's the Federal Reserve's primary inflation measure. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate;

Today: Bureau of Labor Statistics - Employment Cost Index q/q - 8:30am

Why You Should Care: It's a leading indicator of consumer inflation - when businesses pay more for labor the higher costs are usually passed on to the consumer;

Today: Department of Labor - Unemployment Claims - 8:30am

Why You Should Care: Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy;

Earnings Reports

Today: Apple, Amazon, Mastercard, Unilever, Anheuser-Busch InBev (Budweiser), Comcast, Ferrari, CVS Health, Coinbase, S&P Global, Sanofi, MicroStrategy, Roblox

Tomorrow: Berkshire Hathaway, ExxonMobil, Chevron, Colgate-Palmolive, Kimberly-Clark, Moderna

MARKET BRIEF

Leading News

Microsoft's Cloud Empire Strikes Gold: Azure Revenue Hits $75 Billion as AI Bet Pays Off

Photo Credit: Matthew Manuel

Why it matters:

Microsoft (MSFT) just proved that patient capital allocation and strategic AI positioning can turn a mature tech giant into a growth machine—with 39% Azure growth silencing skeptics who worried about cloud market saturation.

Zoom Out:

The Redmond giant delivered a masterclass in how to monetize artificial intelligence without losing your shirt. Revenue jumped 18% to $76.44 billion, the fastest clip in three years, while the stock rocketed 9% after hours toward a fresh record above $550.

For the first time, Microsoft pulled back the curtain on Azure's true scale—$75 billion in annual cloud revenue that's growing at 34%. That's not just impressive; it's validation that CEO Satya Nadella's multi-billion dollar AI gamble is paying dividends.

The company's willingness to spend over $30 billion quarterly on data centers signals confidence that demand for AI computing will only intensify. Smart money follows smart infrastructure.

Key Insights:

The Copilot Effect: Microsoft's AI assistant now boasts 100 million monthly users, driving higher revenue per customer across Office 365 commercial products—a textbook example of AI monetization done right.

Capital Intensity Reality Check: With $120+ billion in annual capex projected, Microsoft is essentially building the digital equivalent of the Interstate Highway System. Expensive? Yes. Necessary for long-term dominance? Absolutely.

Market Position Solidifies: Trading near $4.1 trillion market cap, Microsoft joins Nvidia as only the second company to breach the $4 trillion threshold—a club that's getting more exclusive, not less.

Market Pulse:

"I talked about it, my gosh, in January, and said I thought we'd be in better supply-demand shape by June. And now I'm saying I hope I'm in better shape by December," —CFO Amy Hood on data center capacity constraints, a high-quality problem that signals genuine demand.

Bull’s Take:

Microsoft has cracked the code on transforming AI hype into actual revenue streams while maintaining disciplined growth across legacy businesses. For patient investors, this is what a quality compounder looks like in the AI era.

Headlines

Meta stock surges after Q2 results blow past expectations despite heavy AI spending (link)

AB InBev stock sees worst day since COVID struck after volume miss (link)

Figma prices IPO at $33, above expected range (link)

CVS's revenue rises 8.4% to $98.9 billion in Q2 (link)

Robinhood Earnings Double, But Cryptocurrency Revenue Misses Views (link)

Samsung’s profit more than halves, missing expectations as chip business plunges 94% (link)

CRYPTO

Fear & Greed

Headlines

*Hat-tip to GamblingMemez