- Bull Street

- Posts

- 📈 Netflix's Profit Machine Hits Overdrive

📈 Netflix's Profit Machine Hits Overdrive

Amazon Cuts Cloud Computing Jobs, Uber Invests in Robotaxi Partners, Perplexity Valued at $18 Billion, Burberry Shares Jump on Pivot, PepsiCo Beats Despite US Weakness

Good morning.

⚡ The Fast Five → Amazon Cuts Cloud Computing Jobs, Uber Invests in Robotaxi Partners, Perplexity Valued at $18 Billion, Burberry Shares Jump on Pivot, PepsiCo Beats Despite US Weakness

🔎 Market Trends → S&P 500, Nasdaq end at fresh record highs on data, earnings; US Stocks Edge Up

And now…

⏱️ Your 5-minute briefing for Friday, July 18, 2025:

MARKET BRIEF

Before the Open

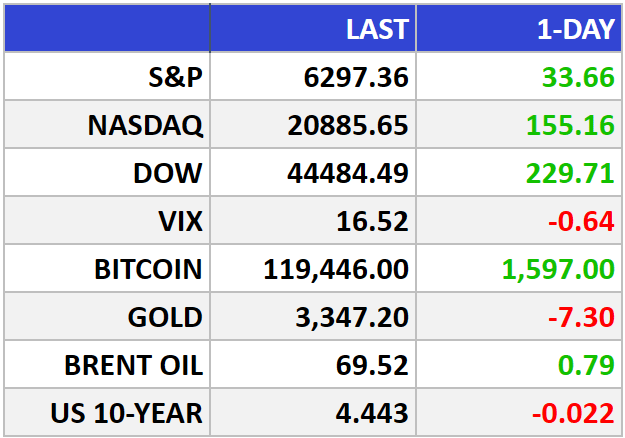

As of market close 07/17/2025.

Pre-Market

|

|

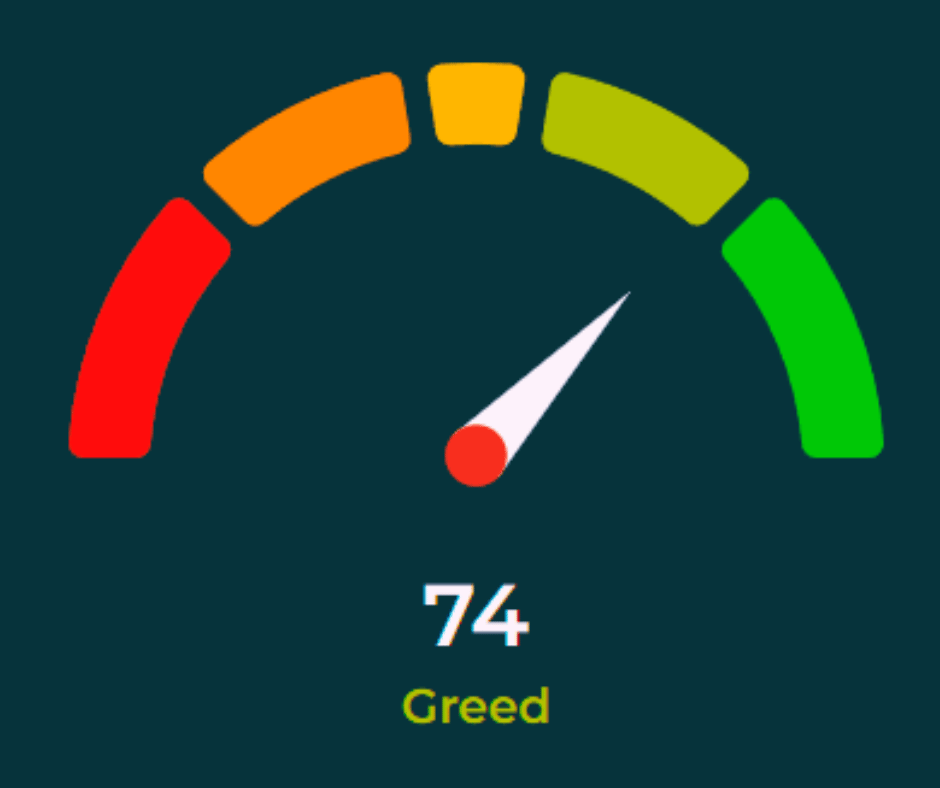

Fear & Greed

Markets in Review

Records Roll In: Nasdaq, S&P 500 Hit New Highs as Data Defies Rate-Cut Hopes

Nasdaq +0.7% to 20,884.3, S&P 500 +0.5% to 6,297.4, Dow +0.5% to 44,484.5 — another banner day for equities. Financials led, while health care and real estate lagged.

The Big Picture:

Wall Street shrugged off rate-cut doubts Thursday as the Nasdaq and S&P 500 logged fresh record closes, powered by robust earnings and consumer resilience.

Retail sales rebounded strongly last month, defying expectations that tariffs would tighten wallets. Instead, consumers may be front-loading purchases ahead of future price hikes.

Meanwhile, jobless claims fell to a 3-month low, reinforcing the labor market's surprising durability. With inflation running hot and economic data firming, the Fed may have to stay on pause longer than markets hoped.

In Washington, Fed Governor Adriana Kugler signaled she’s in no rush to cut, citing looming tariff impacts. That adds tension ahead of the July 30 Fed meeting, especially as other members float the idea of a near-term cut.

Market Movers:

PepsiCo (PEP) +7.5%: Surprise revenue beat + FX headwinds fading = investor refreshment.

Lucid (LCID) +36.2%: Surged on deal to supply 20K EVs to Uber’s (UBER -0.3%) autonomous fleet push.

Elevance Health (ELV) -12.2%: Earnings miss + guidance cut = sector’s worst performer.

Abbott (ABT) -8.5%: Beat Q2, but cautious Q3 outlook spooked investors.

What They’re Saying:

"Consumers shook off their tariff jitters... inflation fears may actually be fueling buying behavior," — Scott Anderson, BMO

WHAT WE’RE WATCHING

Events

There are no events scheduled for today.

Earnings Reports

Today: American Express, Charles Schwab, 3M , Truist (formerly BB&T and SunTrust), Schlumberger, Ally Financial

Monday: Verizon, Domino’s Pizza

MARKET BRIEF

Leading News

Netflix's Cash Engine Hits Peak Performance as Content Costs Loom

Photo Credit: Venti Views

Why it matters:

The streaming giant's 16% revenue surge to $11.08 billion proves its pricing power remains intact, but margin compression warnings signal the perpetual balancing act between growth and profitability.

Zoom Out:

Netflix (NFLX) delivered a textbook example of mature growth Thursday, beating earnings expectations with $7.19 per share versus the $7.08 consensus. The company's decision to stop reporting subscriber numbers—a classic move when growth metrics become less flattering—masks what's actually a sophisticated pivot toward monetization over pure expansion.

The real story lies in Netflix's 91% surge in free cash flow to $2.3 billion, demonstrating that after years of cash-burning content binges, the company has finally achieved the holy grail of entertainment economics: sustainable profitability from recurring revenue streams.

Key Insights:

Operating leverage in action: The 34.1% operating margin represents nearly a 7-percentage-point improvement year-over-year, proving that subscription businesses can achieve remarkable efficiency once they hit critical mass

Ad revenue acceleration: While Netflix remains coy about specific figures, management cited "healthy" ad sales growth, suggesting their advertising tier is gaining traction faster than Wall Street anticipated

Geographic diversification pays: Currency headwinds turned into tailwinds, with international markets contributing meaningfully to the raised guidance range of $44.8-$45.2 billion

Market Pulse:

"The margin warning spooked traders, but smart money recognizes this as investment in future growth," notes one streaming analyst.

Bull’s Take:

Netflix's transformation from growth-at-all-costs to disciplined cash generation represents the maturation every investor hopes to witness. The upcoming content slate—including Stranger Things finale and NFL games—positions the company to defend its moat while competitors struggle with profitability.

Headlines

Amazon Eliminates Hundreds of Cloud Computing Jobs (link)

Oil and Gas Chevron wins Exxon battle over Guyana oilfield (link)

Uber makes multimillion-dollar investment in Lucid and Nuro to build a premium robotaxi service (link)

AI start-up Perplexity now valued at over $18 billion, just months after its most recent funding round (link)

Burberry shares pop 8% as British heritage pivot lures back U.S. shoppers (link)

PepsiCo posts better-than-expected second quarter despite lower US sales (link)

CRYPTO

Fear & Greed

Headlines

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.