- Bull Street

- Posts

- 📈 Novartis Drops $12B on RNA Bet

📈 Novartis Drops $12B on RNA Bet

Novartis just made its biggest bet in over a decade on RNA muscle therapeutics.

Good Morning…

When a Swiss pharmaceutical giant writes a $12 billion check for a biotech that's never sold a single pill, smart investors should ask whether management sees the future more clearly than the market—or simply paid too much for a lottery ticket.

Novartis just placed its biggest bet in over a decade on RNA therapeutics that deliver drugs directly to muscle tissue, simultaneously hedging against looming patent cliffs and Trump's tariff uncertainties while handing Avidity shareholders both a 46% premium and equity in a mystery spin-off company.

🔎 Market Trends → Wall Street notches record closing highs on cool inflation

🖥️ Market Movers from Fintech.tv → [WATCH] Unlocking Crypto: Krista Lynch on Staking and ETP Innovations

And now…

⏱️ Your daily briefing for Monday, October 27, 2025:

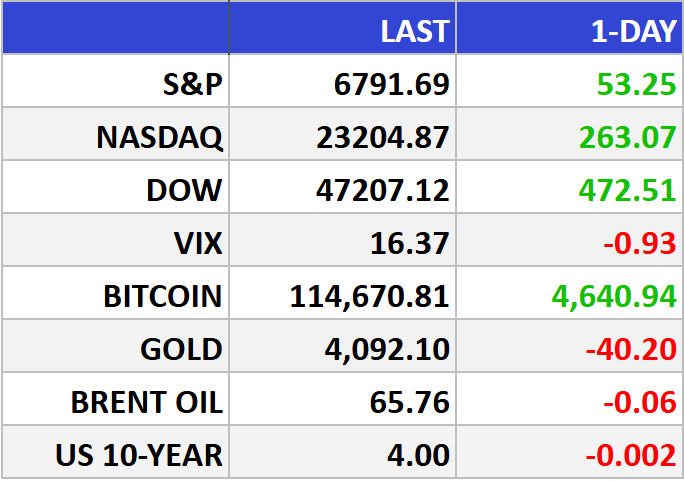

MARKET BRIEF

Before the Open

As of market close 10/24/2025

Pre-Market

|

|

Fear & Greed

Markets in Review

Markets Poised for a Fed-Fueled Rally as Big Tech Steps Into the Spotlight

Stocks ended last week on a record-breaking note: the Dow closed above 47,000 for the first time, the S&P 500 climbed 0.79%, and the Nasdaq gained 1.15%. Futures extended those gains Sunday evening, pointing to more momentum ahead of a pivotal week.

The Big Picture:

Investors are bracing for what could be a double dose of optimism: a widely expected Federal Reserve rate cut and a flurry of Big Tech earnings.

The Fed is almost certain to lower rates on Oct. 29, with 96% of traders betting on a deeper cut to 3.75%–4.00%, according to the CME FedWatch Tool. Cooler inflation data has given policymakers room to ease without reigniting price pressures—a scenario equity bulls have long anticipated.

Meanwhile, the Magnificent 7—Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta (META), and Microsoft (MSFT)—are set to report this week. If Q3 trends hold, expect earnings beats and guidance raises that could push indexes even higher.

Commodities are calm but quietly bullish: oil is hovering near $87 as traders eye potential demand tailwinds from easier monetary policy and easing trade tensions.

Market Movers:

Big Tech tailwind: A stronger dollar and soft rates could expand margins for cloud and AI businesses—particularly Microsoft and Amazon Web Services.

Pharma plays defense: Novartis (NVS) made a bold $12 billion move to acquire Avidity Biosciences (RNA)—a 46% premium that signals renewed confidence in biotech innovation.

Trade thaw catalyst: Hopes rise ahead of the Trump–Xi meeting in South Korea, with U.S. Treasury Secretary Scott Bessent calling talks “constructive and far-reaching.”

What They’re Saying:

A much broader trade framework could be on the table this week—a groundbreaking moment for tech and markets,” said Wedbush analyst Dan Ives.

WHAT WE’RE WATCHING

Events

There are no events scheduled for today

Earnings Reports

Today: Welltower, Cadence Design, Waste Management, NXP Semiconductors, The Hartford, Arch Capital, Nucor, Celestica

Tomorrow: Visa, UnitedHealth, Novartis, NextEra Energy, Booking Holdings, Southern Copper, American Tower, Royal Caribbean

MARKET INSIGHTS

Leading News

Novartis Bets $12 Billion on RNA's Muscle Revolution

Photo Credit: Bloomberg | Getty Images

Why it matters:

This deal signals Big Pharma's growing confidence that RNA therapeutics—not just for vaccines—represent the next frontier in precision medicine, with rare disease markets offering both humanitarian impact and blockbuster economics.

Zoom Out:

Swiss pharma giant Novartis (NVS) is paying $72 per share in cash for Avidity Biosciences (RNA)—a 46% premium that values the clinical-stage biotech at roughly $12 billion. The prize: Avidity's proprietary platform for delivering RNA therapies directly to muscle tissue, targeting neuromuscular disorders with few treatment options.

The acquisition fits Novartis's pattern of strategic portfolio building ahead of a looming patent cliff on blockbusters like Entresto. Rather than defensively hoarding cash, management is deploying capital into growth areas—rare diseases, gene therapies, RNA medicine—where pricing power remains robust and regulatory pathways are accelerating.

Avidity's lead candidate, Del-zota, targets a rare form of Duchenne muscular dystrophy, with three programs eyeing 2026 approval. History teaches us that first-mover advantage in orphan diseases can generate remarkable returns; think Vertex in cystic fibrosis or Alexion in complement disorders.

Key Insights:

The spin-off sweetener: Avidity shareholders get both the $72 cash and equity in a new publicly-traded entity (Spinco) housing early-stage cardiology assets—essentially a free lottery ticket on future breakthroughs. Classic deal engineering that rewards patient capital.

Portfolio insurance play: This marks Novartis's fourth major acquisition in 2025 (following Kate Therapeutics, Anthos, and Regulus). The company is systematically building optionality across rare diseases while diversifying away from looming genericization—textbook risk management for long-term shareholders.

Trump tariff hedge: With 39% tariffs on Swiss goods, establishing deeper U.S. roots through American acquisitions isn't just smart science—it's geopolitical arbitrage. Pharma got exempted initially, but owning U.S. assets provides insurance against policy volatility.

Market Pulse:

"The Avidity team has built robust programs with industry-leading delivery of RNA therapeutics to muscle tissue," said Novartis CEO Vas Narasimhan. Translation: Novartis just raised its 5-year sales growth forecast to 6% from 5% based on this deal alone—a rare vote of confidence at acquisition announcement.

Bull’s Take:

Smart money follows innovation clusters, and RNA therapeutics just got Big Pharma's ultimate validation. For investors in both Novartis and the broader biotech sector, this deal confirms that platforms beat narrow products, and rare diseases remain the industry's profit sanctuary.

Market Stories of Note

Trump-Xi Deal Dodges 100% Tariff Bullet:

The world's two largest economies sketched out a trade truce framework that would avert punishing 100% tariffs on Chinese goods set for November 1st, with Treasury Secretary Scott Bessent declaring the threat "effectively off the table" after weekend talks in Malaysia. The preliminary agreement includes China delaying rare earth export controls for a year, resuming substantial soybean purchases from American farmers, and tackling fentanyl precursor chemicals—pragmatic concessions that calm markets without resolving deeper structural disputes over technology, manufacturing imbalances, or Taiwan. For investors, this represents classic geopolitical risk reduction: not a permanent solution to US-China tensions, but enough oxygen to keep global supply chains functioning and multinational earnings estimates intact while both sides buy time to negotiate the harder issues that "may never be" fully resolved.

Intel's Fourth Straight Beat Signals Turnaround Traction:

The beleaguered chipmaker delivered Q3 revenue of $13.7 billion—beating estimates by $500 million—while posting non-GAAP earnings of $0.23 per share against break-even expectations, marking four consecutive quarters of improved execution. The results carry extra weight given Intel secured $8.9 billion in U.S. government investment and $5 billion from former rival Nvidia, demonstrating that savvy capital still sees value in America's last major domestic chip manufacturer despite a foundry division bleeding cash at a 55% negative operating margin. For patient investors, Intel offers an asymmetric bet on resurgent PC demand and strategic AI partnerships—though Q4's flat guidance reminds us that semiconductor turnarounds rarely move in straight lines.

CRYPTO

Fear & Greed

Headlines

SPONSORED

Company Spotlight

An investment that could save lives and help change the future

ARMR Sciences has reserved the Nasdaq ticker “$ARMR” and is nearing the close of its Series A 7% Convertible Preferred round for accredited investors.

America’s fentanyl crisis kills 200+ people a day and costs an estimated $2.7T annually. DHS has even classified fentanyl as a potential weapon of mass destruction.

Backed by Department of Defense funding and 6+ years of university-led preclinical research, ARMR’s lead candidate blocked 92% of fentanyl from reaching the brain and eliminated addictive behavioral effects in preclinical models.

Their leadership helped develop countermeasures for Ebola, Anthrax, and Dengue. Now they’re aiming to build a first line of defense against synthetic opioids—starting with fentanyl.

Investors in this round receive a 7% annual dividend until listing, automatic conversion to common at IPO, and a 25% discount to the IPO price. Targeted public listing: 2026.

The round is nearing its close. Accredited investors can review and invest now via InvestARMR.com.

This is a paid advertisement for ARMR Sciences. This communication relates to a private placement pursuant to Section 4(a)(2) and/or Rule 506(c) of Regulation D (accredited investors only) and to “testing‑the‑waters” materials for a potential Regulation A offering. No money or other consideration is being solicited for a Regulation A offering and, if sent, will not be accepted. Any offer is made only by the Private Placement Memorandum (and, if pursued, an offering statement on Form 1‑A); read these carefully at InvestARMR.com. The SEC has not approved or disapproved the securities. Investments are speculative, illiquid, and involve a high degree of risk, including possible loss of the entire investment. Reserving a ticker symbol is not a guarantee of going public; any listing is subject to approvals.