- Bull Street

- Posts

- 📈 Nvidia Breaks the $5T Ceiling

📈 Nvidia Breaks the $5T Ceiling

The chipmaker that was worth $1 trillion just two years ago has now crossed $5 trillion

Good Morning…

The chipmaker that was worth $1 trillion just two years ago has now crossed $5 trillion—a velocity of wealth creation that makes even the railroad barons of the 1800s look like they were moving in slow motion.

What's remarkable isn't just the speed of Nvidia's ascent, but that unlike most historic market manias, this one is actually backed by $86.6 billion in trailing profits and a order book so fat it would take two years to fill.

🔎 Market Trends → Wall Street indexes post record closing highs as Nvidia jumps, megacap earnings ahead

🖥️ Market Movers from Fintech.tv → [WATCH] Michael Saylor on Bitcoin’s Ultimate Utility & Strategy’s Standing As The World’s Largest BTC Treasury

And now…

⏱️ Your daily briefing for Wednesday, October 29, 2025:

MARKET BRIEF

Before the Open

As of market close 10/28/2025

Pre-Market

|

|

Fear & Greed

Markets in Review

AI Fever Lifts Stocks to New Highs — Just as the Fed Steps In

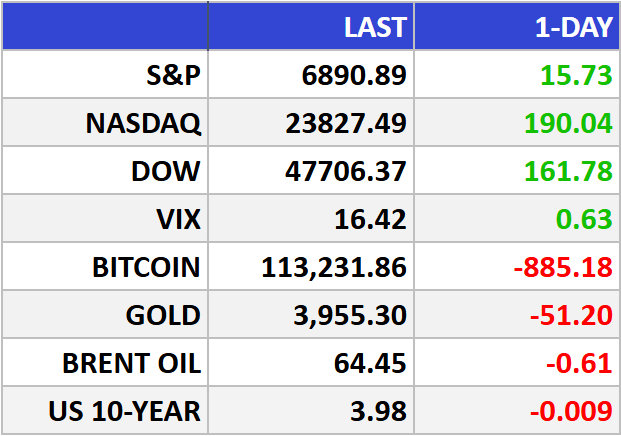

U.S. equities notched record closes for a second straight day, with the S&P 500 up 0.23% to 6,890.89, the Nasdaq Composite climbing 0.80% to 23,827.49, and the Dow Jones rising 0.34% to 47,706.37.

The Big Picture:

When markets hit records the day before a Fed decision, it usually means investors are either over-confident or early. Lately, they’ve been both — and rewarded for it.

The AI trade is still the engine, pulling indexes to levels that seemed unimaginable before 2024. Nvidia (NVDA) — the mascot of this revolution — surged ~5%, fueled by splashy announcements at its GTC conference and a bold $1B stake in Nokia (NOK). That move lit up Nokia shares and signaled that AI is racing beyond software into pipes, towers, and airwaves.

Meanwhile, Microsoft (MSFT) and Apple (AAPL) each vaulted past $4T in valuation, as if market caps were just high scores on a videogame. Their earnings — plus upcoming reports from Alphabet (GOOGL), Amazon (AMZN), and Meta (META) — will shape whether this rally is an AI boom or just an AI mood.

Oil stayed mostly stable; gold popped — not as a panic signal, but as Ray Dalio reminded, “the most fundamental money.” A reminder that even in bull markets, owning ballast is wisdom, not fear.

Market Movers:

• Nvidia (NVDA): +5% — Investor euphoria after GTC and Nokia partnership; new upside in 6G + AI infrastructure.

• Broadcom (AVGO): Riding the same AI datacenter wave.

• Upwork (UPWK): +10% — Web traffic signals revenue tailwinds; analysts turning bullish.

• DraftKings (DKNG) & Flutter (FLUT): −3–5% — Polymarket’s prediction-market push spooks incumbents.

• Royal Caribbean (RCL): −8% — Guidance under-delivered; cruising remains a discretionary luxury.

What They’re Saying:

“This has got to be led by the earnings side of things… and we’ve absolutely seen that.”

— Mike Dickson, Horizon Investments

WHAT WE’RE WATCHING

Events

These events are scheduled but may be effected by the government shutdown

Today: Federal Reserve - Federal Funds Rate; FOMC Statement - 02:00pm

Why You Should Care: It's the primary tool the FOMC uses to communicate with investors about monetary policy. It contains the outcome of their vote on interest rates and other policy measures, along with commentary about the economic conditions that influenced their votes. Most importantly, it discusses the economic outlook and offers clues on the outcome of future votes;

Today: Federal Reserve - FOMC Press Conference - 02:30pm

Why You Should Care: It's among the primary methods the Fed uses to communicate with investors regarding monetary policy. It covers in detail the factors that affected the most recent interest rate and other policy decisions, along with commentary about economic conditions such as the future growth outlook and inflation. Most importantly, it provides clues regarding future monetary policy;

Earnings Reports

Today: Microsoft, Google, Meta, Caterpillar, ServiceNow, Boeing, Verizon, Santander, KLA, UBS, ADP, MercadoLibre, CVS Health

Tomorrow: Apple, Amazon, Eli Lilly, Mastercard. Shell, Merck, S&P Global, Gilead, Stryker, TotalEnergies, BBVA, Anheuser-Busch, Comcast

MARKET INSIGHTS

Leading News

Nvidia Breaks the $5 Trillion Ceiling—And It's Just Getting Started

Photo Credit: Boliviainteligente

Why it matters:

The chip designer surged past $5 trillion in market value, becoming the first company to breach this threshold—a milestone that underscores how deeply AI infrastructure has become embedded in the global economy.

Zoom Out:

CEO Jensen Huang announced $500 billion in cumulative Blackwell and Rubin chip orders through 2026, numbers that would have seemed fantastical just two years ago. The company jumped from $4 trillion in July to nearly $5 trillion now—a pace of wealth creation rarely witnessed outside of tulip mania, except this time there's actual revenue to back it up.

Nvidia commands a staggering 94% share of the AI GPU market as of Q2 2025. That's not dominance—that's near-monopoly. Hyperscalers like Amazon, Google, and Microsoft continue building massive AI data centers, essentially converting investor capital into Nvidia's earnings at an unprecedented rate.

The company's transformation from gaming chip maker to AI infrastructure kingpin represents a masterclass in recognizing inflection points. Trailing-12-month net income hit $86.6 billion—earnings growth so rapid the stock price has struggled to keep pace, not the reverse.

Key Insights:

The pipeline is robust: Blackwell processors are now being manufactured in Arizona facilities, with major construction projects underway in Texas and Virginia. Strategic partnerships with Uber, Palantir, Nokia ($1 billion 6G investment), and Oracle span telecommunications, autonomous vehicles, and government contracts.

Bubble concerns are overblown—for now: Yes, Nvidia's heavy S&P 500 weighting means its moves ripple through pension funds and ETFs worldwide. But unlike dotcom darlings, Nvidia generates massive free cash flow. The total addressable market for AI, autonomous vehicles, and edge computing could exceed $500 billion by 2030.

The competition wildcard: AMD secured deals with OpenAI and Oracle, while Qualcomm enters the AI data center market. More importantly, hyperscalers are developing custom chips to reduce Nvidia dependency—a trend worth monitoring closely.

Market Pulse:

"In many ways, everything that could have gone right for the firm, has gone right over the last sort of 24 hours," said Michael Brown, senior research strategist at Pepperstone.

Bull’s Take:

NVDA remains the rare mega-cap where valuation hasn't completely outrun fundamentals. With shares up 50% year-to-date and earnings still accelerating, this remains a core position for investors willing to stomach volatility. Just remember: nothing goes straight up forever, and position sizing matters more at $5 trillion than it did at $500 billion.

Market Stories of Note

CVS Writes the Prescription for a Turnaround:

CVS Health crushed Q3 expectations with $102.9 billion in revenue (up 7.8%) and raised full-year guidance for the third straight quarter, driven by a recovering Aetna insurance unit where the medical benefit ratio improved to 92.8% and nearly $6 billion in new Caremark contracts. At roughly 10x forward earnings with a 4%+ dividend yield, CVS remains one of the market's better-hidden value plays—provided you can stomach a $5.7 billion goodwill charge that reflects management's belated admission that its clinic expansion dreams exceeded reality.

UBS Digests Credit Suisse—And Serves Up a 74% Profit Surge:

Swiss banking giant UBS crushed Q3 expectations with net profit jumping 74% to $2.5 billion as the Credit Suisse integration races ahead of schedule, having already captured $10 billion of the expected $13 billion in cost savings. Wealth management pulled in $38 billion in net new assets while managing nearly $7 trillion, and the bank released $668 million in legal reserves from old Credit Suisse settlements. At 16.3% underlying return on equity, UBS proves that competent management can extract real value from a shotgun merger—though Swiss regulators may soon demand higher capital buffers that could temper the buyback spree.

CRYPTO

Fear & Greed