- Bull Street

- Posts

- 📈 Occidental's $10B Gambit

📈 Occidental's $10B Gambit

Sometimes the smartest move is selling a good business to fund a great one.

Good Morning…

Warren Buffett didn't become the world's most celebrated investor by backing companies that sell their crown jewels — yet his major stake in Occidental Petroleum suggests something far more intriguing is happening with the oil giant's $10 billion OxyChem divestiture.

🔎 Market Trends → Wall Street indexes end higher as investors weigh inflation data

🖥️ Market Movers from Fintech.tv → [WATCH] Exploring investment opportunities: Insights from the CEO of the Mexican Stock Exchange

And now…

⏱️ Your daily briefing for Monday, September 29, 2025:

MARKET BRIEF

Before the Open

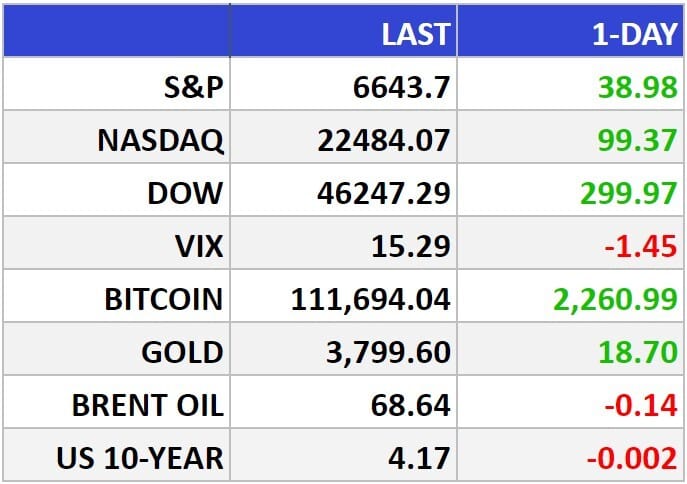

As of market close 09/26/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Inflation Doesn’t Scare the Bull: Why Smart Money Is Staying Put

Dow rose +300 points to 46,247. S&P 500 added +0.59%, closing at 6,644. Nasdaq climbed +0.44% to 22,484.

The Big Picture:

Friday’s modest rally didn’t save the week, but it did steady nerves after a stretch of skittish trading. August’s core PCE — the Fed’s inflation favorite — clocked in at 2.9%, right on target. Not too hot, not too cold.

Markets read the data as “no surprises = no tightening”, offering a brief reprieve to bulls battered by midweek worries over strong GDP growth (+3.8%) and jobless claims. The S&P 500 still snapped a 3-week win streak, but the underlying tone? Resilient.

Meanwhile, oil held near $92/barrel, keeping inflation whispers alive, but not screaming. Commodities didn’t shake equity confidence — a sign that macro headwinds aren't turning into storms.

Market Movers:

Electronic Arts (EA): A private equity mega-deal looms, reportedly nearing $50B. If closed, it would be the largest leveraged buyout ever, lifting EA stock and sentiment.

Oracle (ORCL): AI fatigue set in. Investors are demanding more than buzzwords — fundamentals are back in focus, and Oracle stumbled.

Paccar (PCAR): Trump’s 25% tariff on imported trucks revved up shares of this heavy-duty U.S. manufacturer. Industrial names with domestic advantage got a jolt.

What They’re Saying:

“Yesterday’s GDP and claims undermined the dovish narrative, but today’s PCE calms those worries. No news is good news.” — David Russell, TradeStation

WHAT WE’RE WATCHING

Events

Today: There are no events scheduled for today.

Earnings Reports

Today: Carnival Cruise Line, Vail Resorts, Jefferies

Tomorrow: Nike, PetMed Express, Barnes & Noble Education

MARKET INSIGHTS

Leading News

Occidental's $10B Gambit: When Shedding Assets Makes Perfect Sense

Photo Credit: jetcityimage

Why it matters:

Occidental Petroleum (OXY) is negotiating a $10 billion sale of its OxyChem division — potentially the company's largest divestiture ever — offering a masterclass in strategic capital allocation that could finally silence debt-burden skeptics.

Zoom Out:

Here's a textbook example of how smart management teams think about portfolio optimization. OxyChem generates nearly $5 billion in annual revenue — hardly pocket change — but sometimes the best assets are the ones you sell, not keep.

Occidental's $24 billion debt burden has weighed on shares like an anchor, causing the stock to underperform the S&P 500 by 23 percentage points over the past year. The company has already trimmed $7.5 billion in debt through disciplined asset sales, proving this isn't desperate fire-sale behavior.

Warren Buffett's Berkshire Hathaway didn't become a major backer because of Occidental's chemical prowess. The Oracle sees value in the company's Permian Basin assets and carbon capture potential — areas where this $10 billion could generate superior returns.

Key Insights:

Legacy burden math: Occidental's debt stems from two massive acquisitions — $55 billion for Anadarko (2019) and $13 billion for CrownRock (2023). Smart investors recognize that yesterday's "transformative" deals often become tomorrow's balance sheet millstones requiring surgical correction.

Market timing advantage: Petrochemical margins face a supply glut from new U.S. and Middle East capacity, plus China's domestic buildout. Boston Consulting Group notes 300+ consolidation deals in 2024 — classic end-of-cycle behavior that savvy sellers exploit.

Berkshire's confidence signal: Buffett's firm maintains its large stake despite recent underperformance, suggesting the investment thesis remains intact beyond chemical operations. When the world's most patient capital backs your deleveraging strategy, pay attention.

Market Pulse:

"We are extremely pleased with the progress of our divestiture programme and the trajectory of our debt reduction plans," CEO Vicki Hollub said last month — words that carry more weight when backed by $4 billion in completed asset sales since January.

Bull’s Take:

Sometimes the most contrarian move is the most obvious one. While energy peers slash workforces amid falling oil prices, Occidental is surgically optimizing its portfolio rather than panic-cutting. This $10 billion OxyChem sale represents financial engineering at its finest — trading a decent business for balance sheet freedom that unlocks the company's true potential in carbon capture and premium Permian acreage.

Market Stories of Note

CEO Succession Brewing at Molson Coors:

Molson Coors (TAP) is promoting internal strategy veteran Rahul Goyal to CEO next month, signaling investor confidence in the company's "Beyond Beer" diversification playbook that's quietly building a moat against declining traditional beer consumption. Goyal's 24-year tenure steering partnerships with Coca-Cola on Simply Spiked and acquisitions like ZOA energy drinks demonstrates the kind of patient capital allocation that transforms defensive plays into growth stories. While recent sales dipped 1.6% amid industry headwinds, smart money recognizes that successful leadership transitions combined with strategic portfolio expansion often create compelling entry points for disciplined value investors.

Beyond Meat's Strategic Pivot: Rebranding Reality:

Beyond Meat (BYND) is executing a textbook turnaround playbook—cutting workforce by 6% and rebranding as simply "Beyond"—while revenue plummeted 20% to $75 million as the plant-based boom deflates faster than investors anticipated. The company's shift toward versatile proteins like Beyond Ground (27g protein, four ingredients) represents a savvy pivot away from meat mimicry toward legitimate nutrition positioning, precisely what surviving disruptors do when hype cycles mature. Contrarian investors should note that successful corporate restructuring often begins with harsh cost-cutting and product refocusing—though distinguishing between genuine transformation and elegant decline requires patience that most markets lack.

CRYPTO

Fear & Greed

Headlines

Your daily edge in private markets

Wondering what’s the latest with crypto treasury companies, Pre-IPO venture secondaries, private credit deals and real estate moves? Join 100,000+ private market investors who get smarter every day with Alternative Investing Report, the industry's leading source for investing in alternative assets.

In your inbox by 9 AM ET, AIR is chock full of the latest insights, analysis and trends that are driving alts. Readers get a weekly investment pick to consider from a notable investor, plus special offers to join top private market platforms and managers.

And the best part? It’s totally free forever.