- Bull Street

- Posts

- 📈 Qualcomm's Quiet Siege on Nvidia

📈 Qualcomm's Quiet Siege on Nvidia

The market's 11% endorsement suggests investors grasp that in semiconductor wars, you don't always need to storm the castle.

Good Morning…

While Wall Street obsesses over Nvidia's AI training dominance, Qualcomm just quietly positioned itself to profit from what happens after the models are built—the inference workloads that will run billions of times daily across global data centers.

The market's 11% endorsement suggests investors finally grasp that in semiconductor wars, you don't need to storm the castle—sometimes profitably supplying the siege equipment is the smarter play.

🔎 Market Trends → Wall Street scales fresh highs on tech earnings, trade optimism

🖥️ Market Movers from Fintech.tv → [WATCH] Decentralized Exchanges and the Evolution of Digital Assets: A Conversation with Keith Grossman, CEO of MoonPay

And now…

⏱️ Your daily briefing for Tuesday, October 28, 2025:

MARKET BRIEF

Before the Open

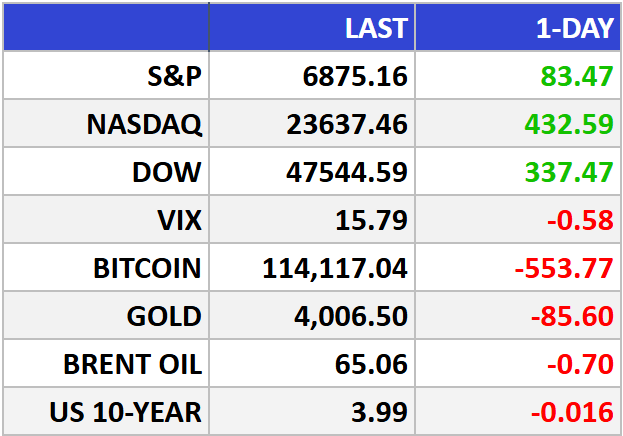

As of market close 10/27/2025

Pre-Market

|

|

Fear & Greed

Markets in Review

Bullish Trade-Truce Boost Lights Up Records for Stocks

The S&P 500 climbed +1.23% to 6,875.16, marking its first close ever above the 6,800 level. The Nasdaq Composite surged +1.86% to 23,637.46, while the Dow Jones Industrial Average gained 0.71% to 47,544.59—all at record highs.

The Big Picture:

Optimism over a potential trade truce between the U.S. and China is fueling the rally. If the world's two largest economies resume meaningful engagement—reducing tariff risks and restoring Chinese purchases of U.S. goods—corporate earnings projections open up nicely. One immediate benefit: companies with global exposure and export dependencies could regain access to China’s massive market.

Tech stocks and chipmakers are taking the lead. The trade thaw reduces a major headwind for firms in semiconductors and high-end manufacturing, helping mobile and AI-chip firms regain momentum.

On the commodities front, easing trade tensions may dampen short-term safe-haven demand—though oil prices still benefit from any supply-side wiggle room. Given the stronger global growth backdrop implicit in the deal, crude and industrial metals remain well positioned for upside.

Market Movers:

Qualcomm Incorporated (QCOM): Up ~11%, after unveiling AI-accelerator chips aimed at data-center inference. This signals a bold shift into higher-margin, growth-moated territory.

Tesla Inc. (TSLA): Jumped ~4.3% and is now up ~61% in six months—well ahead of the S&P’s ~24%. Strong momentum but valuations matter.

Rare-earth miners and export-restriction plays: Firms like USA Rare Earth slipped ~7% after China reportedly agreed to delay new export curbs—showing how policy shifts can flip commodities trades.

Watch small and mid caps: As rate-cut prospects rise, and if recession risks fade, the previously discounted Russell 2000 could enjoy catch-up gains.

What They’re Saying:

“If we end up with some sort of a favorable trade agreement between the U.S. and China… then the two largest trading partners are once again working together. That would also be a very positive sign.” — Sam Stovall, Chief Investment Strategist at CFRA Research..

WHAT WE’RE WATCHING

Events

There are no events scheduled for today

Earnings Reports

Today: Visa, UnitedHealth, Novartis, NextEra Energy, Booking Holdings, Southern Copper, American Tower, Royal Caribbean

Tomorrow: Microsoft, Google, Meta, Caterpillar, ServiceNow, Boeing, Verizon, Santander, KLA, UBS, ADP, MercadoLibre, CVS Health

MARKET INSIGHTS

Leading News

Qualcomm Storms the AI Fortress, Stock Rockets 11%

Photo Credit: Kris Carlon | Android Authority

Why it matters:

The mobile chip stalwart just announced its entry into AI accelerators with purpose-built inference chips—and the market's 11% single-day pop suggests investors believe diversification beats smartphone dependency.

Zoom Out:

History teaches us that dominant market positions rarely crumble overnight, but they can erode at the margins. Qualcomm's AI200 (launching 2026) and AI250 (2027) represent precisely that kind of patient siege warfare against Nvidia's 90%+ market share fortress.

The strategic logic is sound: rather than challenge Nvidia in AI training—where raw compute power reigns—Qualcomm targets inference workloads running deployed models. This plays to their Hexagon NPU expertise honed over years optimizing performance-per-watt in smartphones. The 768GB memory per card and liquid-cooled rack systems aren't revolutionary, but they're table stakes for competing.

What's genuinely intriguing? The AI250's near-memory computing architecture promising 10x bandwidth improvements. If delivered, that addresses inference's primary bottleneck: memory access latency, not compute horsepower.

Key Insights:

The diversification discount: QCOM trades at roughly 15x forward earnings despite this new AI optionality—a steep discount to NVDA's 30x multiple. McKinsey projects $6.7 trillion in data center capex through 2030. Capturing even 3-5% would be transformative for a company seeking post-smartphone growth vectors, yet the market hasn't fully priced in success.

The hyperscaler conundrum: Google (GOOGL), Amazon (AMZN), and Microsoft (MSFT) are building proprietary AI chips. Qualcomm's challenge: prove merchant silicon offers superior economics versus custom solutions. Their modular "mix-and-match" approach—selling components separately—shows sophisticated understanding of hyperscaler buying patterns.

Execution risk cannot be dismissed: Saudi startup Humain's 200-megawatt commitment validates demand, but commercial launches are 12-24 months out. In technology, that's several product cycles for competitors to respond. AMD's recent OpenAI deal and Nvidia's relentless innovation cadence mean standing still equals falling behind.

Market Pulse:

"We first wanted to prove ourselves in other domains, and once we built our strength over there, it was pretty easy for us to go up a notch," said Durga Malladi, Qualcomm's data center GM—a refreshingly candid acknowledgment that credibility precedes conquest in enterprise sales.

Bull’s Take:

Patient investors just received a free option on AI infrastructure at smartphone valuations. The risk-reward asymmetry favors bulls: downside protection from Qualcomm's core handset business, upside leverage to data center penetration. Yes, execution challenges loom and competition intensifies daily. But in a market where scarcity of AI accelerator capacity remains acute, diversified supply wins. Buy the prudent diversification, not the hype.

Market Stories of Note

Amazon's $100 Billion AI Bet Claims 30,000 Jobs:

Amazon's announcement of up to 30,000 corporate job cuts—roughly 10% of its white-collar workforce—crystallizes what discerning investors already suspected: the company is reallocating capital from pandemic-era bloat toward its $100 billion-plus AI infrastructure buildout. CEO Andy Jassy explicitly telegraphed this trade-off months ago, noting that AI efficiency gains would reduce headcount needs even as AWS invests record sums in generative AI capacity. The bull case remains intact: Amazon is pruning to plant, and shareholders betting on operational discipline should view this as management finally matching actions to rhetoric.

Roomba's Requiem: When the Music Stops:

iRobot's 33% plunge Monday matters because it illustrates what happens when insolvency looms and your last suitor walks away—the sole remaining bidder offered a price "significantly lower" than recent levels, corporate-speak for vultures circling wounded prey. With "substantial doubt" about continuing operations and a $200 million Carlyle loan extended for the sixth time since Amazon abandoned its acquisition, iRobot has become a textbook distressed situation. For investors still holding shares near $4, the arithmetic is unforgiving: hope rarely substitutes for strategy when the alternatives are miracle buyer or bankruptcy court.

CRYPTO

Fear & Greed

Headlines

SPONSORED

Company Spotlight

An investment that could save lives and help change the future

ARMR Sciences has reserved the Nasdaq ticker “$ARMR” and is nearing the close of its Series A 7% Convertible Preferred round for accredited investors.

America’s fentanyl crisis kills 200+ people a day and costs an estimated $2.7T annually. DHS has even classified fentanyl as a potential weapon of mass destruction.

Backed by Department of Defense funding and 6+ years of university-led preclinical research, ARMR’s lead candidate blocked 92% of fentanyl from reaching the brain and eliminated addictive behavioral effects in preclinical models.

Their leadership helped develop countermeasures for Ebola, Anthrax, and Dengue. Now they’re aiming to build a first line of defense against synthetic opioids—starting with fentanyl.

Investors in this round receive a 7% annual dividend until listing, automatic conversion to common at IPO, and a 25% discount to the IPO price. Targeted public listing: 2026.

The round is nearing its close. Accredited investors can review and invest now via InvestARMR.com.

This is a paid advertisement for ARMR Sciences. This communication relates to a private placement pursuant to Section 4(a)(2) and/or Rule 506(c) of Regulation D (accredited investors only) and to “testing‑the‑waters” materials for a potential Regulation A offering. No money or other consideration is being solicited for a Regulation A offering and, if sent, will not be accepted. Any offer is made only by the Private Placement Memorandum (and, if pursued, an offering statement on Form 1‑A); read these carefully at InvestARMR.com. The SEC has not approved or disapproved the securities. Investments are speculative, illiquid, and involve a high degree of risk, including possible loss of the entire investment. Reserving a ticker symbol is not a guarantee of going public; any listing is subject to approvals.