- Bull Street

- Posts

- 📈 Red Cat Soars on Defense Supercycle

📈 Red Cat Soars on Defense Supercycle

While defense stocks typically make investors yawn, one tiny drone maker just caught Wall Street's attention

Good Morning…

While defense stocks typically make investors yawn, one tiny drone maker just caught Wall Street's attention with a 292% annual surge—and the smart money thinks the real move hasn't even started yet.

Red Cat Holdings is betting that the future of warfare looks less like F-35s and more like swarms of $50,000 reconnaissance drones, and three separate analyst firms are now convinced they're right.

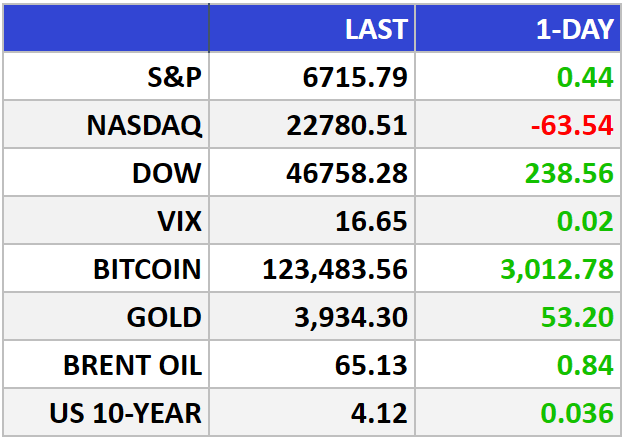

🔎 Market Trends → Dow, S&P 500 post record closing highs; Nasdaq eases with tech

🖥️ Market Movers from Fintech.tv → [WATCH] From Bitcoin Mining to AI: How Tech Giants are Adapting in a Rapidly Changing Landscape

And now…

⏱️ Your daily briefing for Monday, October 6, 2025:

MARKET BRIEF

Before the Open

As of market close 10/03/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Records Tested, Nerves Prodded: Bullish week, wobbly finish

S&P 500 +0.01% to 6,715.79. Dow +0.51% to 46,758.28. Nasdaq −0.28% to 22,780.51. All four majors tagged intraday records before fading.

The Big Picture:

Shutdown, day three. Markets yawned. History says funding lapses are more headline than hard stop—and traders still expect an October Fed cut as the data blackout starves policymakers of fresh reads.

Leadership rotated. Small caps (Russell 2000 +0.7%) outperformed on the week—textbook behavior when rate expectations ease and credit spreads behave. Health care logged its best week since 2022, the market’s version of shock absorbers.

Commodities stayed a tailwind. Crude held in a tight range, keeping input-cost pressure contained and margin math friendlier. Gold stayed firm as a safety bid—insurance against policy noise, not a thesis-killer.

Market Movers:

Health care bid: Biotech tools and services led as investors reached for defensive growth with operating leverage.

Smalls > Bigs: IWM beat mega-cap tech as the rate-cut narrative favors balance sheets that live on bank lines, not buybacks.

AI darlings cooled: Palantir (PLTR −7.5%), Tesla (TSLA −1%+), Nvidia (NVDA ~−1%) slipped after early strength; the VIX popped, a reminder that crowded trades travel with air pockets.

Credit bureaus whipsaw: TRU/EFX bounced after yesterday’s drubbing from FICO (FICO +20%) re-wiring mortgage score plumbing—value migrating to the toll collector.

What They’re Saying:

“We view September’s private substitutes for the delayed jobs report as soft enough to justify another cut… and a 4.11% 10-year keeps multiples afloat.” — Jennifer Timmerman, Wells Fargo Investment Institute

WHAT WE’RE WATCHING

Events

There are no events scheduled for today.

Earnings Reports

Today: Constellation Brands, Toro

Tomorrow: McCormick, Barnes & Noble

MARKET INSIGHTS

Leading News

Defense Drone Maker Takes Flight as Pentagon Spending Surges

Photo Credit: Redcat.red

Why it matters:

Red Cat (RCAT) is capturing a rare convergence—surging military budgets, domestic manufacturing priorities, and a $2.5 billion unmanned vehicle market that's just getting started. The company may turn its first profit in 2026.

Zoom Out:

The drone wars are heating up, and Wall Street is paying attention. Needham initiated coverage with a buy rating and $17 price target—a 32% premium to Friday's $12.89 close. The firm sees Red Cat riding a "multi-year supercycle" in unmanned aerial systems.

History suggests caution with defense contractors during buildups, but this cycle feels different. Small reconnaissance drones proved indispensable in Ukraine, and Pentagon procurement is shifting toward agile suppliers rather than legacy aerospace giants.

Red Cat's already up 292% over the past year—the kind of move that should trigger skepticism. Yet the fundamentals look increasingly solid. An $800,000 order from partner Unusual Machines (UMAC) for FANG drone components suggests imminent customer deliveries, while the pivot into unmanned surface vehicles opens a second growth vector.

Key Insights:

The $200M catalyst: Red Cat's U.S. Army Short Range Reconnaissance contract could generate $200 million in revenue over two years—meaningful scale for a company approaching profitability.

NDAA-compliant advantage: Red Cat's partnership with Unusual Machines delivers American-made, regulation-compliant drone systems—a critical differentiator as Washington restricts Chinese components.

Surface ambitions: The unmanned surface vehicle market represents a $2.5 billion opportunity by 2034, giving Red Cat expansion room beyond its core aerial drone business.

Market Pulse:

"We believe the unmanned aerial systems industry is entering a multi-year supercycle, and view Red Cat uniquely positioned to capture accelerating demand for defense-grade small ISR drones," says Needham analyst Austin Bohlig.

Bull’s Take:

Betting on defense-grade drones isn't chasing the next shiny tech trend—it's recognizing that modern warfare has fundamentally changed, and Red Cat owns a narrow but defensible position in critical defense infrastructure. Just remember: price matters, even in a supercycle.

Market Stories of Note

OPEC Walks Energy Tightrope Carefully:

OPEC+ approved a modest 137,000 barrel-per-day production increase for November—choosing restraint over the more aggressive hikes Saudi Arabia wanted—signaling the cartel knows flooding an oversupplied market would crater prices below $60. This careful calibration matters for energy investors because it reveals deep fractures between Russia (limited by sanctions) and the Saudis (eager to reclaim market share from U.S. shale producers), while Brent crude already shed 8.1% last week on supply glut fears. The takeaway: energy stocks with diversified revenue streams and strong balance sheets should weather OPEC's delicate dance better than pure-play crude producers gambling on sustained price rallies.

Costco Democratizes Blockbuster Weight Loss Drugs:

Novo Nordisk's decision to sell Ozempic and Wegovy through Costco's 600+ pharmacies at $499 per month matters because it represents the first serious attempt by a major pharma player to sidestep insurance gatekeepers and reach the massive uninsured market directly—potentially expanding the addressable patient population by millions. The move signals Novo Nordisk (NVO) is fighting aggressively against compounding pharmacies selling cheaper knockoffs while simultaneously building consumer loyalty before patent cliffs arrive, though the $499 monthly price tag still puts treatment out of reach for lower-income patients who need it most. For investors, this pricing strategy validates the long-term thesis that GLP-1 drugs will evolve from niche diabetes treatments into mass-market preventive medicines, making diversified healthcare portfolios with exposure to both branded manufacturers and retailers increasingly attractive.

SPONSORED

Company Spotlight

This AI stock just proved it's worth 2x its market price

Roadzen Inc. (Nasdaq: RDZN) just closed a $7M financing round for its India subsidiary—at a valuation that implies the parent company is worth $2 per share. That's nearly a 100% premium to where it's trading today.

Led by marquee Indian investors including Team India, Quant AMC, and prominent names like Utpal Sheth and Anand Jain, demand was so strong they increased the round from $4.5M to $7M.

Here's why it matters: India represents roughly half of Roadzen's business. Investors who know that market best just valued it at $91M standalone—signaling serious upside for public shareholders.

Roadzen is transforming auto insurance with AI. Their DrivebuddyAI platform is the only government-validated ADAS system positioned to capture over one million new commercial vehicles annually under India's new safety mandates.

CRYPTO

Fear & Greed