- Bull Street

- Posts

- 📈 SEC X-files

📈 SEC X-files

Global economy set for its worst half decade of growth in 30 years, SEC X account compromised falsely saying Bitcoin ETFs approved, Boeing’s CEO admits ‘our mistake’ after incidents, Morgan Stanley displaces Citigroup as least-loved bank stock, and BlackRock cuts 3% of workforce — just one of many companies...

☕️ Good morning.

The Fast Five → Global economy set for its worst half decade of growth in 30 years, SEC X account compromised falsely saying Bitcoin ETFs approved, Boeing’s CEO admits ‘our mistake’ after incidents, Morgan Stanley displaces Citigroup as least-loved bank stock, and BlackRock cuts 3% of workforce — just one of many companies…

Your 5-minute briefing for Wednesday:

BEFORE THE OPEN

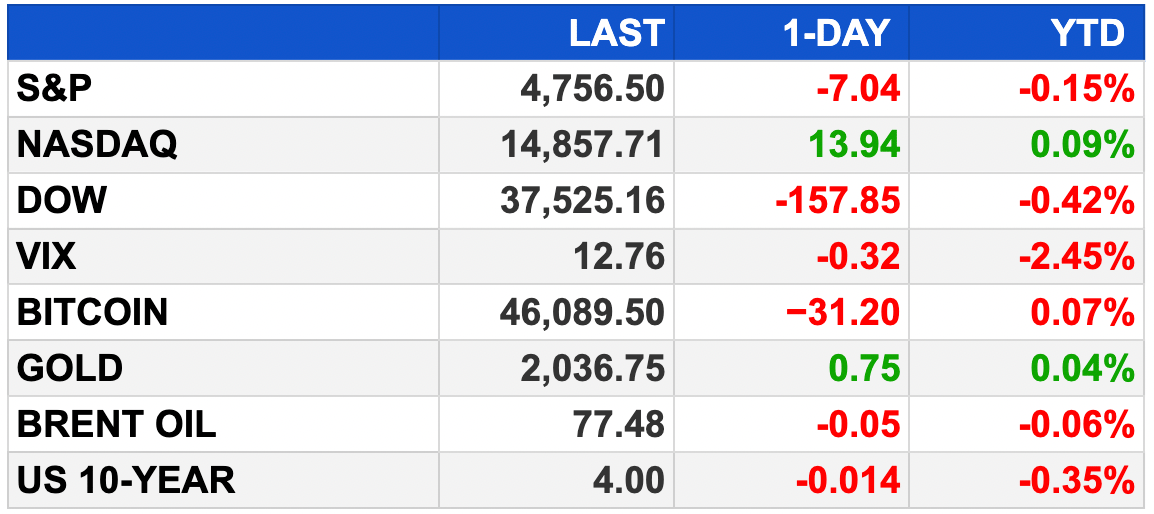

As of market close 1/9/2024.

PRE-MARKET

MARKETS

US stocks mostly closed down, but the indices were supported be a positive day from tech

The Dow led indices with a 0.42% decline, while the Nasdaq rose 0.09%

Asian stocks mostly rose, with Japan’s Nikkei rising 1.16% to a 33-year high thanks to positive Japanese inflation data

EARNINGS

What we're watching this week:

Thursday: Infosys

Friday: JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, United Health, BlackRock, Delta Air Lines

Full calendar here

NEWS BRIEFING

Global growth is forecast to slow for the third year in a row in 2024, dipping to 2.4% from 2.6% in 2023, the bank said in its latest “Global Economic Prospects” report.

The firm said 600 of its employees would lose their jobs. Memo to staff cites unprecedented changes in asset management.

Boeing latest:

Morgan Stanley displaces Citigroup as least-loved big bank stock (link)

SEC X account compromised to falsely say Bitcoin ETFs approved (link)

Finra calls AI 'Emerging risk’ in annual regulatory report (link)

Australia’s top underwriting UBC looks beyond IPOs after 2023 low (link)

Grifols denies Gotham claims as short seller triggers 26% rout (link)

Honda teases new EVs with futuristic ‘Space-Hub’ and ‘Saloon’ concept cars (link)

Trump’s presidential immunity appeal meets judges’ skepticism (link)

Swiss pharma giants plot different paths for next blockbuster drugs (link)

Bill Ackman backs bid by dissidents for Harvard board seats (link)

Intel challenges Nvidia, Qualcomm with ‘AI PC’ chips for cars (link)

Apple veteran Saori Casey leaving to become Sonos finance chief (link)

Article on Ackman’s wife triggers tensions between Business Insider and owner (link)

Match Group names new Tinder CEO after reports of activist stake (link)

Boeing to revise 737 MAX 9 inspection instructions as planes remain grounded (link)

CRYPTO

BULLISH BITES

🥊 Outspoken: Bill Ackman’s latest fight turns personal, again.

😘 Refresh: Miller Lite takes beer breath to a new minty level.

🤖 FOMO: So you want to build a startup off OpenAI? Start here.

💃 Super-droid: AI threatens to push human fashion models right out of the picture.

FEATURED TRADES

$ACR: Trading at massive discount to $25 book value

Acres Commercial Realty Corp is a commercial real estate bridge lender focusing on lending to multi-family properties as well as a mix of office, hotel, and retail. It is associated with Oaktree, a distressed specialist, and is known for operating without paying dividends, allowing flexibility for credit management or share repurchases.

Ticker: ACR | Price: $9.70 | Price Target: $25 (+158%) | Timeframe: N/A

🏠 Real Estate | 🏦 Lender | 📈 Bullish Idea

Read the full article here. Read time: 1 min

DAILY SHARES

Our account was hacked

— Not Jerome Powell (@alifarhat79)

10:53 PM • Jan 9, 2024

What did you think about today's briefing? |

Keep the curation going! Buy the team a coffee ☕️