- Bull Street

- Posts

- 📈 Uncle Sam Goes Mining

📈 Uncle Sam Goes Mining

The Pentagon just became a venture capitalist in a five-person Canadian mining company

Good Morning…

The Pentagon just became a venture capitalist in a five-person Canadian mining company—and if that doesn't signal we've entered a new era of American industrial policy, you haven't been paying attention.

When defense strategists start writing checks for pre-revenue copper explorers in the Alaskan wilderness, the old rules about government interference versus free markets have been rewritten, and savvy investors need to understand what Uncle Sam's equity stake really means for their portfolios.

🔎 Market Trends → S&P 500, Nasdaq reach all-time closing highs on AI dealmaking boost

🖥️ Market Movers from Fintech.tv → [WATCH] AI Momentum and Market Shifts: Analyzing AMD’s Strategic Partnership with OpenAI

And now…

⏱️ Your daily briefing for Tuesday, October 7, 2025:

MARKET BRIEF

Before the Open

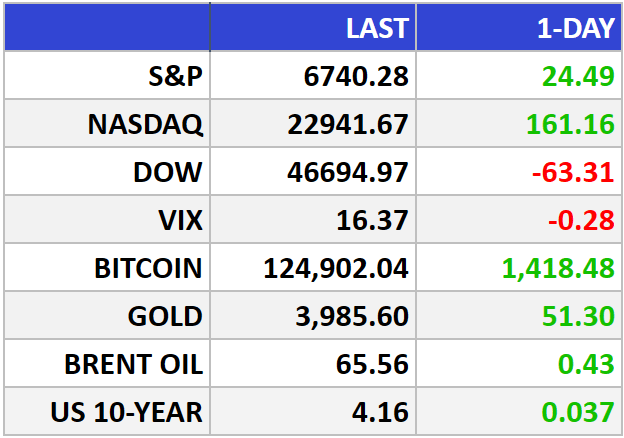

As of market close 10/06/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Deal Fever Lifts Stocks: AMD ignites, M&A wakes up

S&P 500 +0.36% to 6,740.28; Nasdaq +0.71% to 22,941.67—both at records. Dow −0.14% to 46,694.97. Russell 2000 notched a record, too.

The Big Picture:

Wall Street is voting with its wallet: animal spirits > shutdown angst. A burst of dealmaking—chips and banks—rekindled risk appetite and broadened leadership beyond mega-cap AI.

Rates backdrop: With the data spigot partly closed by Washington, investors still expect more Fed cuts. That keeps the cost of capital drifting lower—rocket fuel for M&A math and small-cap reratings.

Commodities: Crude stayed range-bound, muting input-cost pressure. Gold held firm near highs as a policy hedge; helpful ballast, not a thesis.

Market Movers:

AMD (AMD +~24%): OpenAI pact—including a potential 10% stake and multi-year GPU deployments—signals second-source demand and validates AMD’s AI roadmap.

Comerica (CMA +~14%)/Fifth Third (FITB): A $10.9B all-stock tie-up hints at a regional-bank roll-up cycle; KRE +1% on read-through.

Nvidia (NVDA −~0.9%): Sympathy dip as investors handicap share-of-wallet shifts if hyperscalers diversify suppliers.

Dow drags—Sherwin-Williams (SHW), Home Depot (HD): Rate-sensitive spend and housing impulses remain stop-and-go.

What They’re Saying:

“There is clearly an optimistic view of growth in the long term… and everyone expects rates to be much lower by this time next year.” — Brian Mulberry, Zacks Investment Management

WHAT WE’RE WATCHING

Events

There are no events scheduled for today.

Earnings Reports

Today: McCormick, Barnes & Noble

Tomorrow: There are no noteworthy companies for this day.

MARKET INSIGHTS

Leading News

Uncle Sam Goes Mining: Pentagon Backs Trilogy Metals in Historic Industrial Policy Pivot

Photo Credit: Caleb Perez

Why it matters:

The Defense Department is investing in a five-employee Canadian mining explorer—not Silicon Valley tech—signaling Washington's belated recognition that copper mines matter more than apps when supply chains crumble.

Zoom Out:

The Trump administration's $35.6 million investment in Trilogy Metals (TMQ) sent shares soaring 175%+ in premarket Tuesday. But here's the kicker: the deal includes warrants for another 7.5% stake, potentially giving Uncle Sam 17.5% ownership in Alaska's Ambler mining district.

This follows a pattern. Washington recently took equity in Lithium Americas for battery materials and grabbed 10% of Intel earlier this year. The message? Critical infrastructure now means chips, lithium, and copper—not financial engineering.

Yes, Trilogy reported a $1.7 million quarterly loss and runs lean. But that's typical for exploration-stage miners sitting on world-class copper, cobalt, zinc, and lead deposits that Biden's team blocked and Trump's Pentagon now deems essential for national security.

Key Insights:

The warrant sweetener matters: At current prices, those additional warrants represent serious upside optionality. If Ambler lives up to geological potential, the government's fully-diluted stake could approach 20%—creating alignment that makes regulatory interference politically untenable.

Critical minerals arbitrage: These metals power energy infrastructure, defense tech, and manufacturing during an AI boom that's devouring copper for data centers. Supply remains constrained while demand compounds annually.

The Intel precedent: Direct federal equity stakes once seemed unthinkable. Now they're policy tools, reducing permitting risk and signaling long-term commitment that private capital craves.

Market Pulse:

Trilogy praised the move as "a renewed federal commitment to responsible resource development," noting the district contains some of the world's richest copper-polymetallic deposits.

Bull’s Take:

When the Pentagon co-invests in pre-revenue miners, it's not charity—it's strategic necessity that transforms speculative plays into politically-protected infrastructure, creating asymmetric opportunity for investors willing to think like generals, not traders.

Market Stories of Note

Modelo Maker Beats Estimates:

Constellation Brands (STZ) topped earnings expectations by 25 cents per share while reaffirming grimmer full-year guidance, revealing the peculiar reality that a company can execute well tactically while facing strategic headwinds it cannot control. The brewer attributes weakening demand to Hispanic consumers spooked by immigration policy uncertainty—a reminder that consumer sentiment often moves faster than economic fundamentals, creating temporary mispricings for patient investors. Here's the contrarian opportunity: when a premium beer portfolio beats estimates amid peak pessimism about its core customer base, and shares only rise 3%, the market may be overweighting fear and underweighting Modelo's pricing power and distribution gains.

AppLovin's 19% Selloff:

AppLovin (APP) cratered 19% on reports the SEC is investigating whether its AI-powered ad targeting violated data-collection agreements—a probe triggered by whistleblower complaints and short-seller reports, though no formal accusations have been filed against the company or its executives. Here's what matters: a stock up 800% over 18 months naturally attracts regulatory scrutiny and short interest, making it impossible to distinguish legitimate concerns from opportunistic attacks until facts emerge, not innuendo. The bullish case hinges on whether AppLovin's AXON technology genuinely revolutionized mobile ad targeting through legitimate AI innovation—which drove S&P 500 inclusion despite short-seller opposition—or whether its edge came from impermissible data harvesting that regulators will eventually curtail, making this volatility either a buying opportunity for contrarians or a value trap disguised as disruption.

CRYPTO

Fear & Greed

Headlines

UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.