- Bull Street

- Posts

- 📈 Verizon's Space Gamble Bypasses Musk

📈 Verizon's Space Gamble Bypasses Musk

Verizon just placed a multimillion-dollar wager that your next phone call might route through space instead of a cell tower

Good Morning…

Verizon just placed a multimillion-dollar wager that your next phone call might route through space instead of a cell tower—and they're betting against Elon Musk to do it.

This isn't just telecom industry inside baseball: it's a masterclass in how blue-chip companies make calculated gambles on unproven technology, and why the distinction between "visionary investment" and "expensive mistake" often takes a decade to reveal itself.

🔎 Market Trends → S&P 500, Nasdaq end higher as tech stocks shine

🖥️ Market Movers from Fintech.tv → [WATCH] Tokenized Stocks Growing Along with Tokenization Industry

🚨 News Alert: Israel, Hamas agree to first phase of Gaza peace plan, allowing release of hostages and prisoners

And now…

⏱️ Your daily briefing for Thursday, October 9, 2025:

MARKET BRIEF

Before the Open

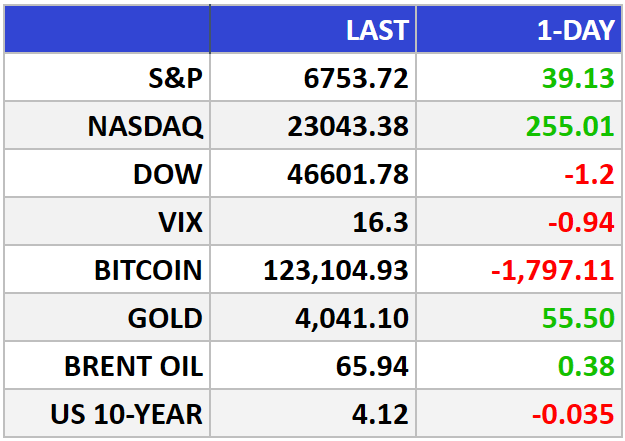

As of market close 10/07/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Record Highs, Real Cash Flows: Markets Look Past D.C. Drama

S&P 500 +0.58% to 6,753.72 (record); Nasdaq +1.12% to 23,043.38 (record); Dow −0.00% to 46,601.78. Tech, utilities, industrials all closed at fresh highs.

The Big Picture:

Wall Street is treating the shutdown as a headline, not a handicap. Earnings power—and a cheaper cost of capital as the Fed debates additional cuts—keeps the bid intact. When policy is noisy, cash flows win.

AI skepticism after Oracle (ORCL) faded fast. Nvidia (NVDA +2%) steadied the tape as CEO Jensen Huang said computing demand has “gone up substantially” over the last six months—reassurance that capex isn’t circular theater.

Factor mix matters: defensives with yield (utilities) and cyclical operators (industrials) climbed together—rare harmony that argues for breadth. Oil stayed contained, muting input-cost risk, while the dollar drift keeps global earnings translations friendly.

Market Movers:

Utilities (XLU): Bond-like cash flows in a soft-rate regime; AI datacenter power needs add a real-asset kicker. Leaders included SO and XEL—new highs on visible dividend growth.

Tech platforms: NVDA rose on reaffirmed end-demand; hyperscaler and start-up spend still compounding.

Oracle (ORCL): Margin worries in cloud/AI rentals (including pricey NVDA GPUs) fueled a rethink: the AI P&L won’t arrive on one invoice.

Select consumer/financial pockets: Shutdown chatter pushes investors toward quality balance sheets and away from credit-sensitive names.

What They’re Saying:

“We know AI can do a lot… but there needs to be demand for the chips… The demand still being there… is reassuring.” — Ross Mayfield, Baird

WHAT WE’RE WATCHING

Events

Today’s events are scheduled but may be effected by the government shutdown

Today: Department of Labor - Unemployment Claims - Tentative

Why You Should Care: Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy;

Earnings Reports

Today: Pepsico, Delta Air Lines, Levi Strauss

Tomorrow: There are no noteworthy companies for this day.

MARKET INSIGHTS

Leading News

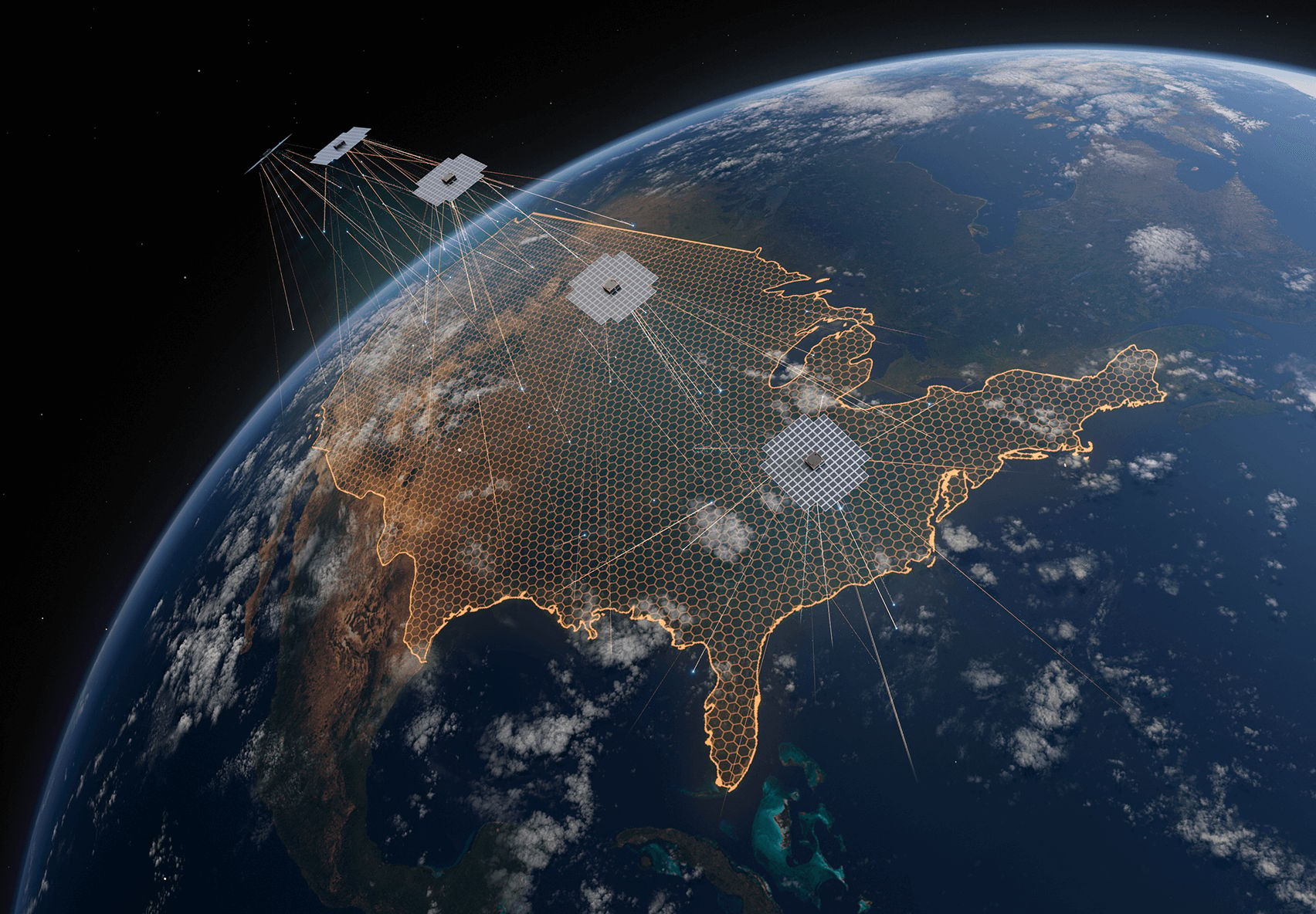

Verizon Bets Big on Space Phones—Without Elon Musk

Photo Credit: AST Space Mobile

Why it matters:

The nation's largest wireless carrier just doubled down on a tiny satellite startup instead of Starlink, potentially reshaping how 271 million Americans stay connected—and creating a compelling, if risky, investment narrative.

Zoom Out:

Verizon (VZ) signed a commercial agreement with AST SpaceMobile (ASTS) to deliver standard cellular service directly from low-Earth orbit satellites—no special equipment required. Your existing phone becomes satellite-enabled.

The deal comes as ASTS stock has surged 340% this year, turning a speculative bet into Wall Street's latest obsession. Rocket Lab (RKLB) will launch additional satellites, while Verizon plans to offer service commercially in 2026.

Here's the behavioral finance twist: Investors are paying $6.8 billion for a company with minimal revenue, betting that space-based cellular represents the next paradigm shift. History suggests most "paradigm shifts" disappoint.

Key Insights:

The technology advantage: ASTS satellites communicate with unmodified smartphones using standard spectrum—a genuine engineering achievement that competitors including SpaceX haven't matched. Five test satellites are operational; the network needs roughly 60 to achieve continuous U.S. coverage.

The valuation puzzle: ASTS trades at astronomical multiples of sales because, well, it barely has sales yet. Early-stage investors who understand binary outcomes might allocate 1-2% of risk capital here. Everyone else should wait for actual revenue.

Verizon's strategic hedge: The carrier is making what behavioral economists call an asymmetric bet—modest capital commitment now for potential massive competitive advantage later. If ASTS succeeds, Verizon dominates rural connectivity. If it fails, the write-off barely dents a $170 billion balance sheet.

Market Pulse:

"We're not just adding another connectivity option—we're potentially eliminating dead zones for every American with a smartphone," said Hans Vestberg, Verizon's CEO, channeling the optimism that's added $5 billion to ASTS's market cap in recent months. Translation: The hype is priced in, but the technology might actually work.

Bull’s Take:

Smart money watches this space carefully but remembers that Iridium went bankrupt before eventually succeeding. The prize—ubiquitous global connectivity—justifies Verizon's exploratory investment, not necessarily yours.

Market Stories of Note

Costco's Digital Sales Surge Powers Another Win:

Costco's September same-store sales climbed 9%, driven by a 20.3% jump in e-commerce that suggests the warehouse giant is mastering omnichannel retail while competitors fumble. The company's ability to blend bargain-hunting psychology with digital convenience creates a rare moat—customers who started buying toilet paper in bulk are now ordering furniture online, sticky behavior that compounds over time. For patient investors, Costco (COST) remains that unusual retailer where membership fees fund competitive pricing, creating a virtuous cycle that's difficult to disrupt and even harder to resist shopping at.

TSMC's AI Chip Boom Beats Expectations:

TSMC reported third-quarter revenue of $23.5 billion, surpassing forecasts as artificial intelligence demand transforms the world's most important chipmaker into something resembling a monopoly with a waiting list. The Taiwanese giant's dominance in advanced semiconductor manufacturing—producing chips for everyone from Apple to Nvidia—creates what Warren Buffett would call a toll bridge on the digital economy, where AI's computational appetite pays ever-increasing fees. For investors wondering whether the AI rally has legs, TSMC's results suggest the infrastructure buildout is real, measurable, and far from finished—though paying 25 times earnings requires faith that today's frenzy becomes tomorrow's foundation.

CRYPTO

Fear & Greed

Headlines

You’ve Hit Capacity. Now What?

You built your business by saying yes to everything. Every detail. Every deadline. Every late night.

But now? You’re leading less and managing more.

BELAY’s eBook Delegate to Elevate pulls from over a decade of experience helping thousands of founders and executives hand off work — without losing control. Learn how top leaders reclaim their time, ditch the burnout, and step back into the role only they can fill: visionary.

It’s not just about scaling. It’s about getting back to leading.

The ceiling you’re feeling? Optional.