- Bull Street

- Posts

- 📈 Walmart's Tariff Test

📈 Walmart's Tariff Test

Today's earnings will either validate or demolish the thesis that trusted value brands can raise prices without losing customers.

Good Morning…

While Wall Street obsesses over Walmart's quarterly tea leaves, the real story unfolds in the aisles where America's spending habits reveal whether scale can indeed trump tariffs—and whether the world's largest retailer has quietly engineered its next competitive advantage from what competitors see as crisis.

🔎 Market Trends → Nasdaq, S&P 500 end lower as investors sell pricey tech stocks

🖥️ Market Movers from Fintech.tv → Bullish Outlook: How Energy Prices and Tech Investments Shape the Future [WATCH]

And now…

⏱️ Your 5-minute briefing for Thursday, August 21, 2025:

MARKET BRIEF

Before the Open

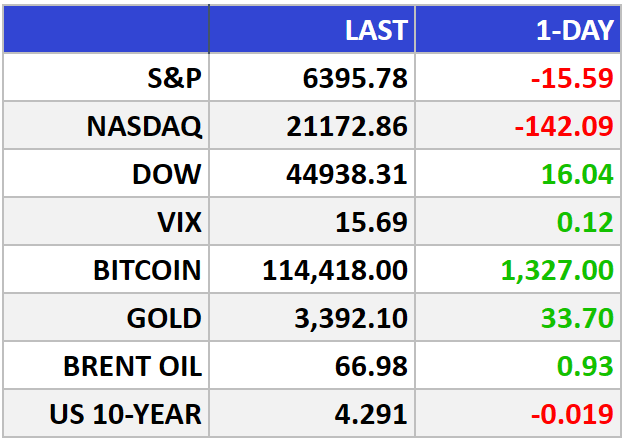

As of market close 08/20/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Tech Stumbles, but Breadth Is Building

The S&P 500 slipped 0.24% to 6,395.78, the Nasdaq shed 0.67% to 21,172.86, while the Dow ticked up 0.04% to 44,938.31 — its resilience underscoring that the bull case extends beyond tech.

The Big Picture:

Investors are catching their breath. After a scorching run that saw parts of tech up 80%+ since April, profit-taking isn’t panic — it’s rotation. Nvidia (NVDA), AMD (AMD), and Broadcom (AVGO) dipped, but the selling looks like a pause in the AI trade, not its obituary.

Commodities and energy remain steady, providing ballast. With tariffs reshaping supply chains, demand for U.S.-sourced inputs — from oil to steel — looks set to rise, keeping inflation talk alive but also fueling industrial plays.

Meanwhile, the Fed minutes confirmed policymakers are split: some fear inflation lingers, others see cracks in labor. Futures markets still price in an 80% chance of a September rate cut, which could re-ignite growth stocks after this late-summer lull.

Market Movers:

Tech under pressure: Intel (INTC) plunged 7% on valuation and CHIPS Act uncertainty. Palantir (PLTR) fell 1%, extending a six-day slide. Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), and Meta (META) all slipped.

Retail split-screen: Target (TGT) sank 6% on weak sales and CEO change, while Lowe’s (LOW) climbed on better-than-expected earnings and an $8.8B acquisition bet.

Healthcare spark: Medtronic (MDT) jumped 4% after lifting guidance, showing tariff impacts may be less painful than feared.

What They’re Saying:

“It’s not a surprise to see some investors taking profits in tech stocks, which have had an incredibly strong run,” said Carol Schleif, chief market strategist at BMO Private Wealth. “Thin August trading makes swings look bigger than they are.”

WHAT WE’RE WATCHING

Events

Today: Department of Labor - Unemployment Claims - 8:30am

Why You Should Care: Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy;

Today: S&P Global - Flash Manufacturing Purchasing Managers' Index (PMI); Flash Services Purchasing Managers' Index (PMI) - 9:45am

Why You Should Care: It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy;

Earnings Reports

Today: Walmart, Ross Stores, Zoom, Intuit, Newsmax, MINISO, Workday

Tomorrow: BJ’s Wholesale Club, The Buckle, Bridgford Foods

MARKET INSIGHTS

Leading News

Walmart's Tariff Test: How America's Retail Giant Survives and Thrives

Photo Credit: David Montero

Why it matters:

Walmart's (WMT) Q2 earnings Thursday will reveal whether scale trumps tariffs in the battle for consumer wallets—offering crucial clues about household resilience and retail's evolutionary path.

Zoom Out:

The Arkansas behemoth faces its most complex earnings backdrop in years. With 33% of merchandise sourced internationally and tariffs creating cost pressures, Walmart must navigate between its "everyday low prices" DNA and economic reality.

Yet history suggests betting against Walmart's adaptability is often foolish. The company has transformed tariff headwinds into competitive tailwinds, using its $648 billion revenue scale to absorb costs rivals cannot while simultaneously attracting higher-income shoppers—a demographic shift that defies conventional retail wisdom.

The real story isn't whether Walmart raises prices (it will), but whether consumers accept those increases from their trusted value champion.

Key Insights:

The Tariff Math: Wall Street expects 74 cents EPS on $176.16 billion revenue, but Walmart declined earnings guidance due to tariff volatility—a rare admission from the forecasting-obsessed retail sector

Digital Gold Rush: The company achieved its first profitable e-commerce quarter globally in May, leveraging advertising revenue and third-party marketplace commissions to offset margin pressure

Market Share Warfare: While competitors struggle with tariff absorption, Walmart's 3.5-4.5% sales growth guidance positions it to capture market share from smaller retailers forced into steeper price hikes

Market Pulse:

"We're wired for everyday low prices, but the magnitude of these increases is more than any retailer can absorb," CFO John David Rainey —a rare admission of vulnerability that paradoxically signals strategic strength in acknowledging reality over wishful thinking.

Bull’s Take:

Walmart's tariff challenge is the market's gift to long-term investors. The company that survived Amazon's assault by embracing omnichannel retail will likely emerge from tariff turbulence with enhanced competitive moats and a more profitable customer mix.

Market Stories of Note

Google's AI Gambit: Pixel 10 Bets the Future on Mobile Intelligence:

Google's Pixel 10 series launches with advanced Gemini AI features while Apple delays major Siri updates until 2026, creating a rare window for Alphabet (GOOGL) to capture AI-hungry consumers who no longer want to wait for promised features. The $799-$1,799 device lineup includes a year of Google's typically $19/month "AI Pro" subscription, essentially monetizing the company's AI research while building consumer habits around premium AI services. Smart investors should note that Google is betting its mobile future on the thesis that consumers will pay for AI convenience—a behavioral shift that could either validate or devastate the company's smartphone ambitions within 18 months.

Palantir's Growing Pains: When AI Darlings Meet Reality Checks:

Palantir's (PLTR) 20% plunge from recent highs offers a textbook lesson in why momentum stocks inevitably face gravity, as the data analytics company grapples with a 193x forward P/E ratio that would make even Silicon Valley blush. The selloff follows Citron Research's pointed observation that Palantir trades at a premium to OpenAI despite generating a fraction of the AI revenues, highlighting how market euphoria often disconnects from fundamental analysis. Smart investors should view this correction as a reminder that even the most promising AI companies must eventually justify their stratospheric valuations with sustainable earnings growth.

CRYPTO

Fear & Greed

Headlines

Practical AI for Business Leaders

The AI Report is the #1 daily read for professionals who want to lead with AI, not get left behind.

You’ll get clear, jargon-free insights you can apply across your business—without needing to be technical.

400,000+ leaders are already subscribed.

👉 Join now and work smarter with AI.